Case Solution

What should a customer be willing to pay for one of Curled Metal Inc.’s new cushion pads? What factors are relevant in calculating the willingness to pay in this situation?

Please prepare a specific monetary estimate of customer value in this situation.

When calculating the value of Curled Metal Inc.’s new cushion pads to the customers, one has to consider a variety of factors. These are the total costs per hour of pile driving, the saved costs for driving, and the savings in changing times.

By calculating the total amount of money saved when applying the new pads, one can calculate the “real value” of the product.

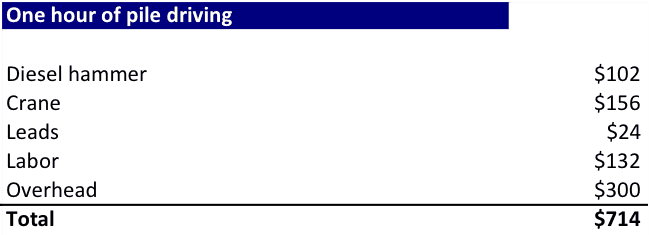

One “real hour’s” worth of pile driving for CMI’s new cushion pads is calculated as follows:

One real hour of pile driving for Curled Metal Incorporated’s new cushion pads has a total cost of $714. We will use this number for further calculations.

Below I have calculated the total costs for driving time, replacing pads for both the Kendrick Foundation Company and Corey construction:

When comparing the total sum of the contracts, one will recognize that the cost difference between conventional pads and CMI pads is $30.738,90 for the Kendrick case and $30.738,90 for the Corey case.

By dividing these numbers by the sets used on the job, one will recognize the value per set of CMI pads. Since the number of sets used is 1 in this case, the values equal the cost differences as given above.

Dividing these values by the number of pads per set, one will identify the value per set, $5,123.15. In other words, a customer should be willing to pay any price below the calculated „real value“ per pad of $5,123.15.

What price should CMI set for one of its new cushion pads? Why?

Please focus on an 11.5-inch cushion pad.

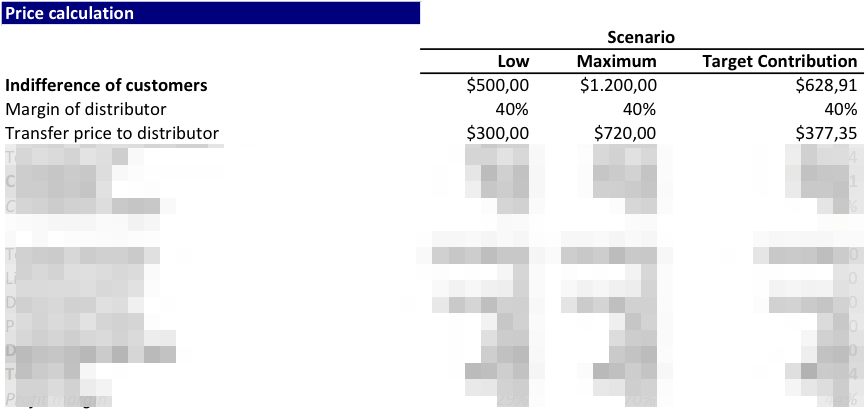

First, one needs to consider the indifference price for both the Kendrick Foundation Company and Corey construction:

Second, considering the aforementioned indifference price, the target contribution margin of 45%, and the distributor margin of 40%, one can now calculate the recommended target selling price.

In short, the recommended target price for one of the new 11.5-inch cushion pads is $628.91.

The perspective of customers: There is an evident gap between the „real value“ of $5,123.15 and the recommended target selling price. Therefore, the pricing for customers is attractive enough to undergo the process changes needed to realize the savings. Like reduced human error and injuries related to changing the pads, additional savings are not even included in the calculation.

The perspective of CMI: Initially, it is important to catalyze product adoption and gain market share by setting rather reasonable profit margins. However, at a later stage, and as more data about the customer’s buying behavior regarding CMI’s products becomes available, CMI should carefully raise the selling price by approaching the real value of the pads.

Please prepare an integrated strategic option for Curled Metal Inc – an option that specifies your price but also specifies the many other choices facing Curled Metal Inc. in formulating a strategy for its new cushion pads (e.g., in marketing, sales, distribution, production, finance, and other functions).

On page 1 of the case, Curled Metal Incorporated’s vice president Joseph Fernandez says, “The way we price this could have a significant impact on everything else we do.” An integrated strategic option specifies the basic type of advantage a company will pursue (e.g., differentiation? low cost? other?), relevant decisions about the customer and product scope, and key choices throughout the company’s value chain.