Western Asset Arbitrage - Case Solution

This Western Asset Arbitrage case study discusses collateralized debt obligations (CDO) and its origin.

Case Questions Answered

- What is a CDO? Explain how it works.

- Where does CDO's value come from?

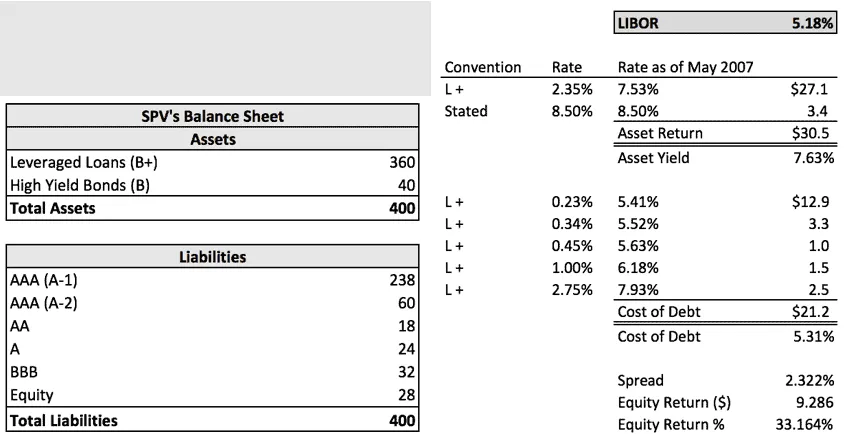

- Construct SPV's balance sheet. What is the expected return to the unrated tranche (equity)? Would you invest in the equity tranche? Why?

- How do the risk considerations affect CDO structuring?

- Who are the typical investors in CDO tranches?

- What is the role of the rating agencies in the securitization process?

- Describe the advantages and disadvantages of securitization. What kinds of assets can be securitized?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

1. What is a CDO as used in this Western Asset Arbitrage case study?

Explain how it works.

Collateralized debt obligations or CDOs, as used in this Western Asset Arbitrage case study, were born in the late 1980s by Drexel Burnham Lambert Inc. CDOs have since grown enormously in size, volume, and variety, and they have become a vital component of the structured finance market.

The product is a corporate entity that holds assets as collateral and sells packaged cash flows to investors. The process starts with an issuer, generally an investment bank, which establishes a particular purpose vehicle to buy and hold the portfolio of cash-flow-generating debt securities. The cash flow from the underlying pool of securities is sold to investors who take a position in the special purpose vehicle (not the assets directly).

The pool of assets is reallocated in a manner that layers the risk in combinations called tranches of varying risk (e.g., senior tranches, mezzanine tranches, equity tranches) in alignment with market preferences. The seniority of these tranches corresponds to the order in which cash flows are paid (and the reverse order in which losses affect investors).

2. Where does CDO’s value come from?

A collateralized debt obligation value comes from the underlying assets contained within the special purpose vehicle. Different investors have varying preferences for risk, depending on their investment philosophy, mandate, or portfolio diversification.

The creation of CDOs essentially allows arbitrage to be realized for the equity investors if mispricing exists in the market between the relatively high-yield assets and lower-yield liabilities contained within the CDO. Using the CDO as a vehicle, the issued product aims to earn a higher rating than the underlying assets.

3. Construct SPV’s balance sheet. What is the expected return to the

unrated tranche (equity)? Would you invest in the equity tranche? Why?

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy