Victoria Chemicals PLC (B): The Merseyside and Rotterdam Projects - Case Solution

This Victoria Chemicals PLC (B): The Merseyside and Rotterdam Projects case study is part of a series of cases. This case study deals with a project review of a planned improvement of a polypropylene production plant. The executives of the company must decide on either mutually exclusive projects.

Case Questions Answered

- How do the two projects (Merseyside and Rotterdam) compare on the basis of Victoria Chemicals PLC's investment criteria? What might account for the differences in rankings? Are they mutually exclusive?

- Is it possible to quantify the value of potentially adding Japanese technology to the Merseyside project? How, if at all, does this flexibility affect the economic attractiveness of the project?

- Which project should James Fawn propose to the chief executive officer and the board of directors?

- Why are the Merseyside and Rotterdam projects mutually exclusive?

- How do the two projects compare on the basis of Victoria Chemicals' investment criteria? What might account for the differences in rankings?

- Is it possible to quantify the value of potentially adding Japanese technology to the Merseyside project? How, if at all, does this flexibility affect the economic attractiveness of the project?

- What are the differences in the ways Elizabeth Eustace and Lucy Morris have advocated for their respective projects? How might those differences in style have affected the outcome of the decision?

- Which project should James Fawn propose to the chief executive officer and the board of directors?

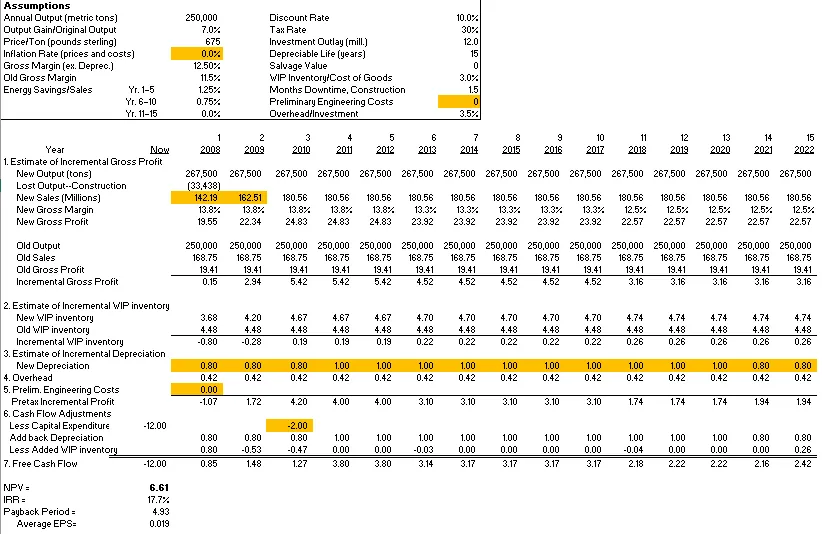

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

1. How do the two projects (Merseyside and Rotterdam) compare on the

basis of Victoria Chemicals PLCs’ investment criteria? What might account for the differences in rankings? Are they mutually exclusive?

In Victoria Chemicals PLC (A), I changed the inflation rate to 3%. However, I noticed that in the Rotterdam Project analysis, the inflation rate was 0% while the discount rate remained at 10%.

To remain consistent, I changed my inflation rate back to zero. By doing this, my NPV, IRR, and EPS went down. The payback period would actually be 5.26, which went up (I screenshotted my graph before I calculated the payback period). So, the payback period also went up.

One thing that accounts for the differences in ranking done by Victoria Chemicals PLC would be the fact that the Rotterdam project slowly increases new output rather than having the new output maxed out in year one.

The construction downtime is another factor that accounts for the differences in ranking. The Merseyside project accounts for 1.5 months of construction, while the Rotterdam project accounts for many months over 3 different years of construction.

As far as mutual exclusivity, this question is a bit complicated. It seems that if the Rotterdam project is chosen, then the Merseyside project could not be chosen (making them mutually exclusive).

However, if Victoria Chemicals PLC chooses the Merseyside project, there is an opportunity to implement the technology from the Rotterdam project in the future (making them not mutually exclusive). So I would say both yes and no.

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy