Universal Circuits, Inc. - Case Solution

The Irish controller was worried that the current favorable situation for Universal Circuits, Inc., the strengthening of the US dollar, will not continue for long. If that happened, the company would be in a highly disadvantageous situation as the company's functional currency is the dollar, and all sales are invoiced in dollars. Does the Irish controller have a convincing argument for the weakness of the dollar? Why or why not? How do you interpret the evidence?

Case Questions Answered

- Does Universal Circuits, Inc.'s Irish controller have a convincing argument for the weakness of the dollar? Why or why not? How do you interpret the evidence?

- In view of the fact that the dollar is the Irish subsidiary's 'functional currency,' should the controller be worried about its exchange value? What is the nature of the foreign exchange exposure(s) faced by the Irish subsidiary? Why isn't the Irish subsidiary's functional currency the Irish punt?

- Would you approve the controller's request to buy punt forward? What considerations factor into your decision?

- Considering Universal Circuit's exposures worldwide, what general policy would you recommend concerning the handling of foreign exchange exposures? Should all exposures be covered or just some? How much of a role, if any, should local operating managers play in exposure management?

1. Does Universal Circuits, Inc.’s Irish controller have a convincing

argument for the weakness of the dollar? Why or why not? How do you interpret the evidence?

The Irish controller was worried that the current favorable situation for Universal Circuits, Inc., the strengthening of the US dollar, would not continue for long. If that happened, the company would be in a highly disadvantageous situation as the company’s functional currency is the dollar, and all sales are invoiced in dollars.

He supported his argument based on the fact that the American trade deficit had reached a huge excess of $100 billion, which would eventually lead to a depreciation of the US dollar.

An excess in trade deficits, with exports lower than imports, indicates that the US is exchanging its currency to buy foreign goods more than the foreign demand for the US dollar, placing downward pressure on the US dollar.

The Irish controller is particularly worried about a possible weakening of the dollar against the punk since Universal Circuits, Inc. has set up its manufacturing in the Irish subsidiary;100% of the company production occurs in Ireland.

From one side, this concern of the Irish controller is understandable if we take a look at the exchange rates between the dollar and the pound over the past years.

From Exhibit 1, we can see that over the years, the punt has been continuously appreciating against the dollar, especially from 1980-1984, when the punt/dollar rate increased from 0.53 to 1.01.

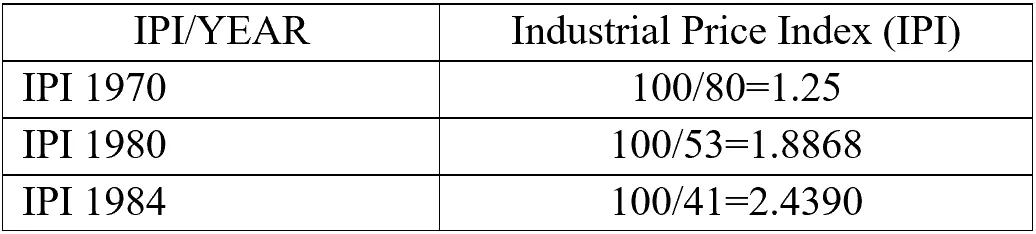

Also, from exhibit nr.1, we can notice a gradual decrease in US relative industrial prices in terms of relative prices in Ireland. The Relative industrial prices between the US and Ireland (USA/Ireland) have been as follows:

Year 1960=100; Year 1970=80; Year 1980=53; and Year 1984=41. The year 1960 is taken as the baseline. The industrial prices index is used as a measure of inflation from the perspective of producers.

According to the PPP, the spot rate with respect to another currency will…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy