Time Value of Money: The Buy Versus Rent Decision - Case Solution

In this "Time Value of Money: The Buy Versus Rent Decision" case study, a recent MBA graduate had been renting an apartment while a similar flat had been listed for sale. The graduate is now facing the typical buy versus rent decision. Hence the grad decided to apply some of her analytical tools acquired in business school to make this decision for her personal life.

Case Questions Answered

- What is the best solution to take -- to rent or to buy?

- What are the assumptions you use?

- Calculate the best route for the graduate's housing situation, developing your understanding of the time value of money (TVM) concepts and calculations.

- Describe your assumptions, methodology, and results in your discussion narrative, and attach a simple spreadsheet supporting your analysis.

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

BACKGROUND – Time Value of Money: The Buy Versus Rent Decision Case Study

The case is about Rebecca Young, who just completed her MBA and moved to Toronto for her new job in the banking industry. She is having a dilemma between renting or buying a condo instead.

A condo unit is an identical unit next door to her rented unit. She has been renting for more than a year, and she really thinks she can afford the monthly amortization, knowing that she has a secured job in the next 5-10 years.

Let us list the facts of the case:

Her monthly rent is $3,000, and this does not include utilities and cable television, but parking is included in the monthly rent.

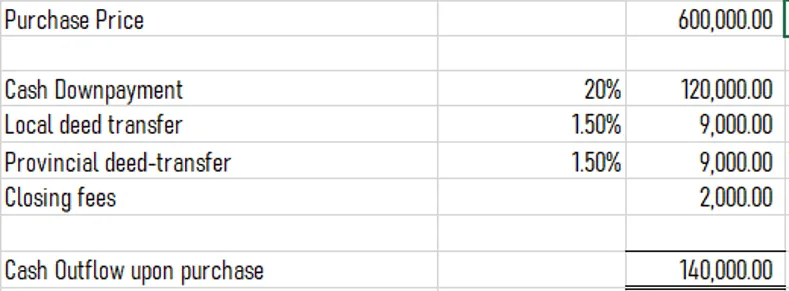

The purchase price of the unit is $620,000, but Rebecca thinks she can get it for $600,000. 20% of the purchase price is needed for a downpayment. This will also include both a local and provincial deed-transfer tax of 1.5% of the purchase price – this is both payable and due on the purchase date. A closing fee is estimated to be around $2,000. The total cash outlay on the purchase date totals $140,000, broken as follows:

Rebecca requested to model the amount of the outstanding principal at various points in the future, two, five, and ten years from now, and this was presented to her.

There were also scenario cases that she considered in her analysis before making her final decision. These scenario cases are presented below and are described accordingly:

- The condo price remains unchanged.

- The condo price drops 10% over the next two years, then increases back to its purchase price by the end of five years, and then increases by a total of 10% from the original price by the end of ten years.

- The condo price increases annually by the annual rate of inflation of 2% per year over the next ten years

- The condo price increases annually by an annual rate of 5% per year over the next 1ten years.

These scenario cases are properly illustrated and calculated using the Excel platform.

PRESENTATION:

Case 1 is presented to Ms. Young as saying that she is renting the condo and intelligently pursuing to invest the cash outlay of $140,000. The future value of this investment at year 2 is…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy