Tata Tea Limited (A) - Case Solution

Tata Tea Limited is the second-largest seller of packet tea in India. Sometime in 1999, the company was challenged by some impending deregulation, which would affect its local market. Thus, the tea company is considering operating in the global market. It is, however, in a dilemma on how to invade the international scenario and how to introduce its brand. It is also contemplating the purchase of Tetley Tea, an internationally-renowned tea brand. Should it internationally market its own brand or just go ahead and purchase Tetley Tea?

Case Questions Answered

- Analyze the industry scenario.

- Evaluate Tata Tea Limited and Tetley Tea.

- Evaluate the Global and Indian Tea Industry.

- Motives for the deal.

- Which Tea Industry is attractive?

- Is the acquisition good for the Tea Industry? How does it help the Indian Tea Industry? Global Tea Industry?

Tata Tea Limited (A) Case Study Analysis

This case study revolves around Tata Tea Limited, a seller of packet tea in India, which is considering acquiring Tetley Tea in the year 2000.

Tata Tea Limited

Tata Tea Limited is the second-largest seller of packet tea in India, following HUL. The company owns 54 tea estates in India, 25,700 hectares of which are under cultivation, and has a revenue of £125 M.

It has its own on-site processing facilities plus six packaging facilities. In addition, six more packaging facilities outside the estates where tea bought at auction were blended and packaged. 80-90% of its tea production is for its own branded tea, and the remaining percentage is sold via auction/export.

The company owns the biggest instant tea facility outside the US. The facility is located in Munnar. It produces different blends catering to regional tastes and consumer preferences across the nation.

It has a network of over 600,000 outlets consisting of supermarkets, grocery stores, and roadside stalls located mostly in larger villages, towns, and cities and has a lesser presence in rural areas. Only a small percentage of its business is engaged in exporting its products, which only accounts for 12% of its sales and 3.5% of Indian tea exports.

Tetley Tea

On the other hand, Tetley Tea is the world’s second-largest tea company, having a revenue of £323 M. It has a strong presence in the UK and the US markets (Retail, food service, and institutional sales). 54% of its revenues are from the UK market, 26% from the US, and 20% from the global market.

It exports to more than 30 countries and has five manufacturing facilities in the UK, US, and Australia. The company has a joint venture (JV) with Tata Tea Limited in India.

The company purchases more than 1 million kg of tea each week. The business Tetley has centralized tea-buying operations in the UK. It offers a 2% commission to agents.

Tetley practices a grading system for consistency to maintain its quality. Its main product is Teabags. 92.5% of its tea is in the form of tea bags, and has 60 black tea blends. It specializes in black teas like Earl Grey, fruit- flavored tea, and iced tea. It also boasts of its plain and flavored green teas, decaffeinated teas, and herbal infusions.

The Tea Industry at a Glance

Production

- 2.86 billion kg produced worldwide. 30 countries. 2.4 million hectares of land

- 76% Black, 24% Green

- India, where Tata Tea Limited is based, was the largest producer. 28% of world production of 870 million kg. +Largest variety

- China (24%)

- Sri Lanka (10%)

- Kenya (9%)

- Production Growth: 1.7% annually

- Price Growth: 8-10% annually

Consumption

Annual per capita consumption:

- Ireland (3.2 kg)

- UK (2.5 kg)

- Turkey (1.8 kg)

- Iran (1.8 kg).

India was the largest consumer of tea in terms of total consumption, but per capita consumption was at 0.66 kg per year

Developing countries >> Increasing trend

Developed countries: >> Mature Market: health-conscious

- Key sources of growth: branding, competitive pricing, and product innovation

UK, Ireland: all-day, everyday hot drink

- Sales vol (high) AND less possibility of adding more exp

variants

- Sales vol (high) AND less possibility of adding more exp

• US and continental Europe: Sophisticated Image

- flavor and origin are important

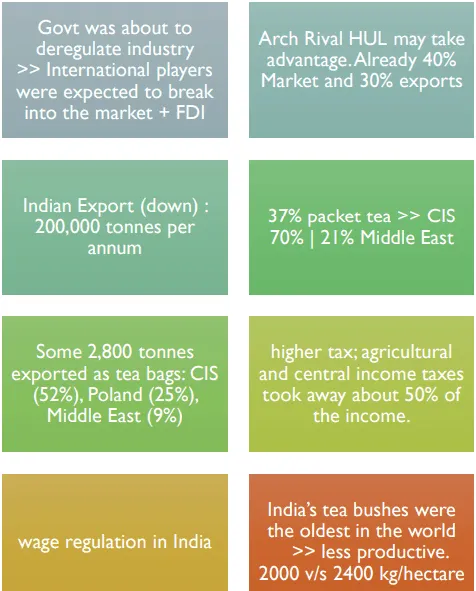

Indian Scenario (For Tata Tea Limited)

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy