Superior Manufacturing Co. - Case Solution

In order to come up with a decision for its product line, the management of Superior Manufacturing Co. must examine the cost data of the company and consider the same in its decision.

Case Questions Answered

- Based on the 2004 statement of profit and loss data of Superior Manufacturing Co., do you agree with Water's decision to keep product 103?

- Should the company lower its price of Product 101 as of January 1, 2006? To what price?

- Why did the company improve profitability during the period January 1 to June 20, 2005? How useful was the data in Exhibit 4 for the purpose of this analysis?

- Why is it important that the company has an effective cost system?

- What is your overall appraisal of the company's cost system and its use in a report to management?

- What recommendations, if any, would you make to Waters regarding the company's cost accounting system and its related reports?

- If the company sells 100,000 units of any of the three products, which product should be chosen?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

1. Based on the 2004 statement of profit and loss data of Superior

Manufacturing Co., do you agree with Water’s decision to keep product 103?

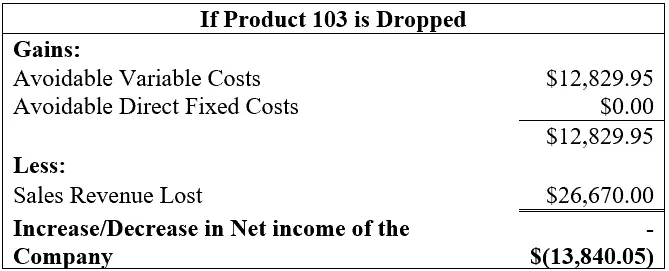

The allocated fixed costs are unavoidable costs. The entire $16,153.05 would be incurred with or without Product 103. A portion of these costs is actually absorbed by Product 103’s segment income. If Superior Manufacturing Co. drops Product 103, it will result in lower overall net income. Hence, the product line should not be dropped.****

By dropping Product 103, the company will lose sales revenue from the product line. However, the company will also obtain gains in the form of avoided costs.

But it can avoid only the variable costs and direct fixed costs of product 103 and not the allocated fixed cost. Thus, in conclusion, we agree with Water’s decision to keep Product 103.

Conclusion

If Superior Manufacturing Co. keeps all 3 products, it will have a net profit of $58029.85. If the company drops product 103, It will have a net profit of 41,978.80. If it drops product 103, the net profit will decrease.

2. Should the company lower its price of Product 101 as of January 1,

2006? To what price?

- Explain why we use the same unit variable cost (10.2) [Excel Q2(1)]

First of all, 2005 is not closed yet. Since the prices change, the unit variable costs change in both ways.

- What is the price? [Excel Q2(2)]

Superior Manufacturing Co. should go to…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy