Star River Electronics Ltd. (V. 1.2) - Case Solution

Star River Electronics had early success producing and selling compact discs, also known as CD's, to companies in the music industry as well as for consumers who needed more storage on their computers. The most significant problem at hand for the company and its CEO would be determining whether to wait three years to buy new packaging equipment for the DVD's to produce output and hopefully save money on cost like labor.

Case Questions Answered

- Executive Summary

- Overview

- Statement of the Problem(s)

- Analysis

- Recommendations

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Executive Summary – Star River Electronics Ltd.

Star River Electronics is a joint venture between venture capitalist firm New Era Partners and Starlight Electronics Ltd.

Star River Electronics had early success producing and selling compact discs, also known as CDs, to companies in the music industry as well as to consumers who needed more storage on their computers.

As the developing markets continued to grow, such as the gaming industry, these disks needed to be able to hold more gigabytes.

New advancements in storage technology helped to create higher memory disks called DVDs and blue-ray discs. With smaller companies not being able to produce this new technology, much of Star River Electronics’ competition was eliminated.

As more and more innovative products continue to come to markets, alternatives are putting pressure on Star River Electronics. Consumers who were originally CD consumers are now using online streaming services such as YouTube, Spotify, Apple Music, and more.

As sales in North America have been unpleasant, emerging-market countries’ sales continue to increase as the company continues to receive profitable results from blue-ray disks. Experts in the industry have predicted a decrease in the CD and DVD market but a stable increase in the blue-ray disk market.

The new CEO of Star River Electronics, Adeline Koh, has requested historical data, as well as forecasting future values from assistant Andy Chin, to help assist her with various problems.

One of the issues is due to CDs only producing around 5% of sales for the firm. This may be caused by old packaging equipment breaking and causing overtime to be paid out for employees.

One of the options available was to purchase new equipment that would save Star River Electronics SGD 286,878.00. The company can also wait three years to buy new equipment after the old machine has fully depreciated, the cost of machinery and maintenance going up 5% per year, and the inflation rate being 1.5% per year.

Another issue faced by Adeline is whether the firm can finance new equipment based on forecasted statements in the next two years.

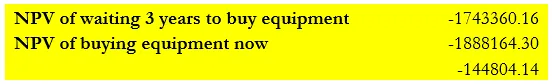

After running calculations, if Star River Electronics were to wait three years to buy the new equipment, the net present value would be 1,743,360.16. If the company were to buy the machine now, the net present value would be 1,888,164.30.

If the company were to wait, they would actually be saving a total of 144,804.14. It would be a great financial move because as the company’s short- term debt continues to grow, as well as historic ratios at the time (2015), Star River will be unable to finance the new equipment.

Overview

As online streaming services continue to be a considerable part of the world, companies like Star River Electronics need to produce DVDs more efficiently, such as blue-ray disks.

Star River Electronics is looking to expand its operation on DVDs, which includes new machinery that produces faster with fewer errors. The new packaging machine will also cut down cost labor and increase the amount of DVDs that will be able to be produced.

CEO Adeline Koh wants to figure out if the company can finance the new project, as well as if waiting three years or buying new equipment now will save them money. The new machine costs 1.82 million Singapore dollars, which would depreciate at a constant of 182,000 a year for ten years.

Statement of the Problem(s)

The most significant problem at hand for Star River Electronics and Adeline Koh would be…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy