Sephora Direct: Investing in Social Media, Video, and Mobile - Case Solution

The senior VP of Sephora Direct, Julie Bornstein, seeks to intensify the company's social media and other digital marketing strategies as it saw some improvement after two years of implementation. As the company has a limited budget, Bornstein must justify the need for additional funding for these strategies for 2011. Would allocating more budget for intensifying its online presence worth it?

Case Questions Answered

- Should Sephora Direct further scale back their circulation and perhaps the length of their catalogs?

- At what point should Sephora stop printing and mailing altogether?

- Everyone loves Sephora's catalogs. They showcase Sephora as a trendsetter and an expert, but can their videos do that as well?

Sephora Direct History

Sephora Direct was a company with a single store, incorporated in France in 1969. A pioneer of trial and experiment, it was taken over by LVMH in 1997. A year later, it entered the US market via New York. It has a $2 billion revenue from the US, Canada, and Sephora.com.

The stores of Sephora Direct carry red, white, and black colored themes, and cast members wear similarly themed uniforms.

All throughout the stores, pop, and alternative music are played to exude a fun and party atmosphere. The company carries prestigious brands like Mac and Chanel, and its target customers are 25-35-year-old women.

As to its marketing strategies, the company has store window merchandising, distributes a 32-page print catalog, and has direct mail pieces.

It has two major promotions and gives free gifts to beauty insiders. Email marketing is also undertaken for beauty insiders and advertises in online searches and other online platforms.

There are several touchpoints between the company and its customers. It includes Sephora stores, Beauty Insider, Facebook, YouTube Videos, Beauty Talk, and a mobile application.

Sephora Direct SWOT Analysis

Strengths

- Largest online beauty site

- Passionate and engaged customers

- Promotions

- Social Media

Weaknesses

- No distribution of Chanel/MAC brands

- Lack of an Android app

- Stores only in the metropolitan area

Opportunities

- Jennifer Aniston’s fragrance launch

- New e-commerce partnerships

- Integration with UGC on YouTube

- Cross-branding opportunities

Threats

- Ulta Stores

- Amazon.com

- Beauty.com

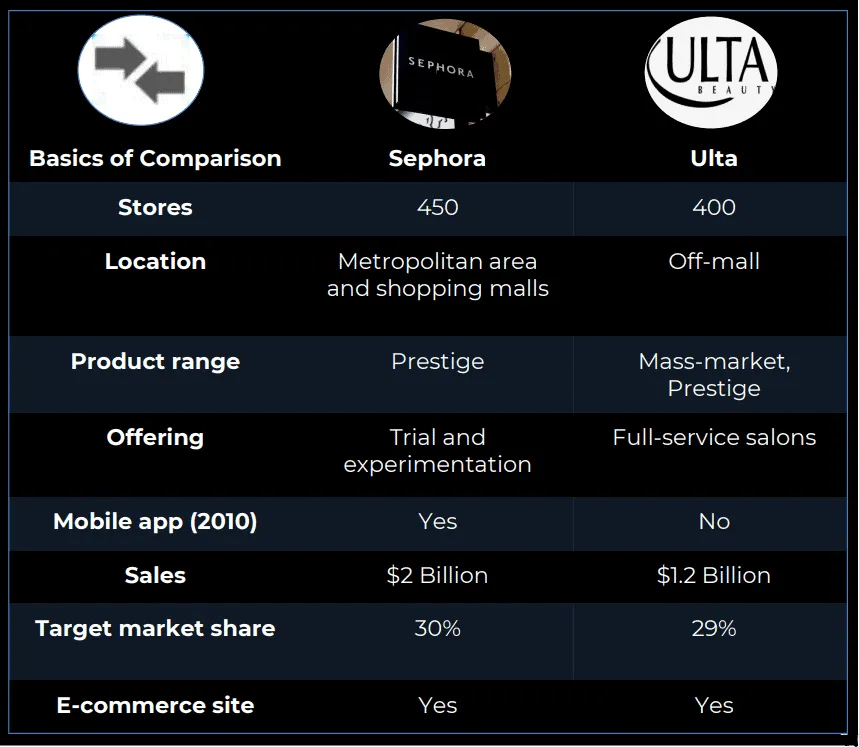

Sephora vs. Ulta Beauty Stores

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy