RJR Nabisco - Case Solution

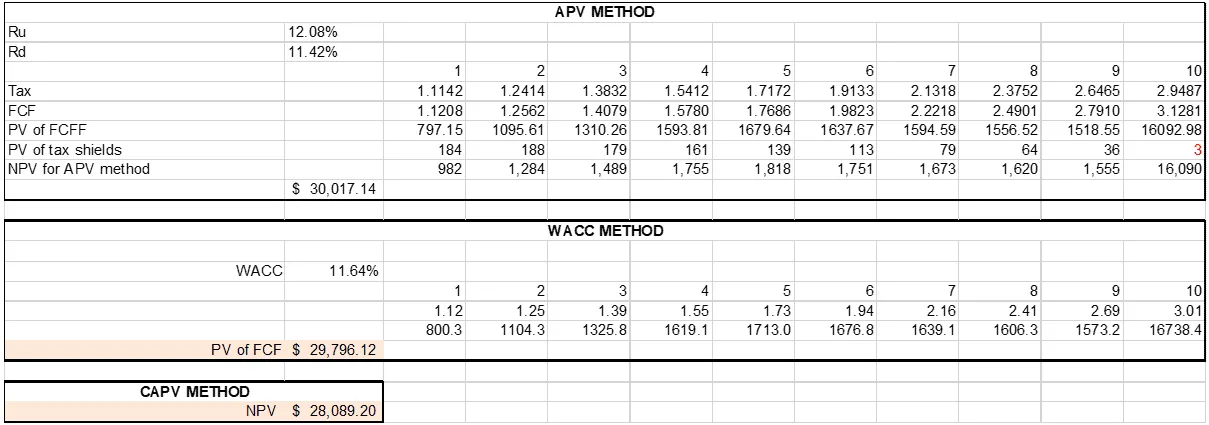

This RJR Nabisco case study analysis looks deeper into how the stream of FCFs and tax shields were determined for the three different valuations methods, which are APV, WACC, and CAPV.

Case Questions Answered

- For each of the three plans (Prebid, Management, and KKR):a) Calculate the free cash flow for each yearb) Estimate the tax shield for each yearc) Estimate the unlevered discount rated) Value RJR Nabisco

- Estimate the stock price of RJR under each of these plans.

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

RJR Nabisco Firm Value Calculations – Details and Assumptions

The value of the firm RJR Nabisco has been evaluated for three different scenarios using three different valuation methods, which are APV, WACC, and CAPV.

This report delves deeper into how the stream of FCFs and tax shields were determined for these methods.

Estimation of Tax Rates for each of the three buyout proposals:

- Prebid – To calculate Profit Before Taxes (PBT) for RJR Nabisco, we deduct the interest expense from EBIT. From PBT, Net Income is subtracted to calculate the taxes & tax rates for each year.

- Management and KKR – PBT is calculated as operating income minus the net of interest expense and amortization amount.

Estimation of Cash Flow for each of the three buyout proposals: FCF = EBIT (1 – Tax Rate) + Depreciation – Capex – Changes in WC + Proceeds from asset sales

- Prebid – The EBIT numbers have been plugged from exhibit 5

- Management and KKR – EBIT numbers are calculated as Operating Income minus the Amortization value. For KKR, the noncash interest expense has been ignored.

Adopting the going concern principle, it is assumed that RJR Nabisco will continue to function profitably in the future.

The cash flows from the 11th year (1999 onwards) have been assumed using the cash flow of 1998 as a base with a growth rate of 3% (approx. GDP growth for the US). Hence, the discounted cash flows for the 10th year include the…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy