RegionFly: Cutting Costs in the Airline Industry - Case Solution

RegionFly is an airline company focusing on ultra-premium services. For several decades, it has performed well in the financial aspect of the airline travel industry. Currently, it experienced a decline as the Great Recession affected including the airline industry. Larger airline companies enter into mergers and acquisitions which strengthened their competitiveness. Due to the financial decline, the company was acquired by another larger company. Top management employees were displaced and the new team of managers implemented strong cost-cutting measures. These measures affected the labor force and some culture of the company that brought it to success were done away with. However, these moves did not bring up the company financially. To some point, the company eliminated two of its routes but still, it did not raise its profitability. RegionFly is now looking into cutting yet another route.

Case Questions Answered

- Analyze the profitability of Route 7 in 2014 with the current allocation method of the overhead cost. Should RegionFly go about shutting down operations of Route 7 to bring back the profit levels? If not, why?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Analyze the profitability of Route 7 in 2014 with the current allocation

method of the overhead cost. Should RegionFly go about shutting down operations of Route 7 to bring back the profit levels? If not, why?

RegionFly has been trying for a long time to cut down on its operating costs and increase its profitability. However, even after consulting with an outsourced consulting firm and with several cost-cutting measures being taken, the company’s profitability is still going down.

Therefore, the management now faces the question of whether they should shut down yet another route with the hopes of increasing profitability or not.

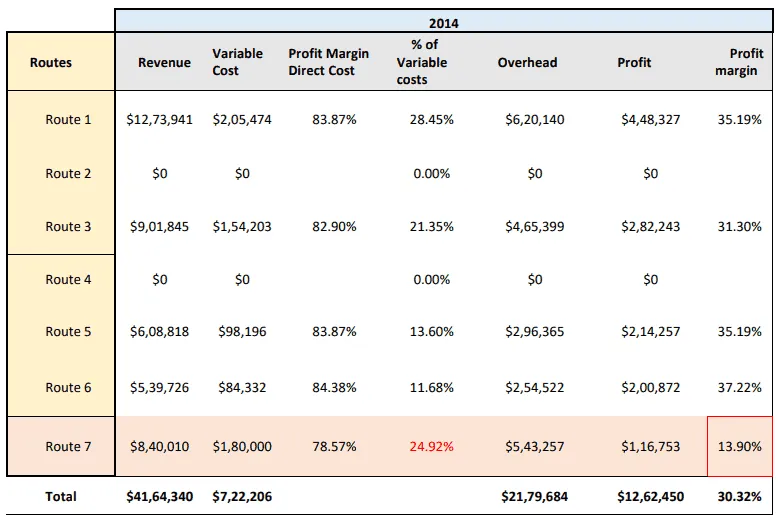

To answer this question, we started first by analyzing the profitability of RegionFly in 2014 with Route 7 as operational.

Route 2 and 4 were already closed; hence, they are taken as 0.

We observe that the profitability of Route 7 here comes to 13.90%, which is much lower than the company’s target, which is 25% per route. Seeing this, one could conclude that we should stop operating on route 7 so that the profit margin could increase from 30% to 34 %.

However, that may not be the case. If we look at how the company developed from 2012 to 2013 after eliminating route #2 and route #4, we can see that the overhead costs didn’t decrease in the amount they should have, considering how the current overhead cost is being distributed.

If we look at the year 2012, we find the variable cost of Route #2 and Route #4 totaling 28.78% (18.57 + 10.21) of the total variable costs, and thus the overhead cost should have decreased by…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy