Polyphonic HMI: Mixing Music and Math - Case Solution

The Chief Executive Officer of Polyphonic HMI, Mike McCready, was in the planning stage of launching an AI tool. The artificial intelligence is known as Hit Song Science (HSS). The said tool is designed to identify the characteristics of current music in relation to past hits. The analysis would be used to determine the potentiality of the current song of becoming a hit as well. Mike McCready is looking into which market to target with the new tool. Should he target record companies, producers, or independent artists? And how could he protect his creation from possible future replication?

Case Questions Answered

- What is the Break-Even point for Polyphonic HMI?

- How would you evaluate the Markets for Polyphonic?

- Estimate the Value Created by Hit Song Science.

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Polyphonic HMI and Hit Song Science (HSS)

The Chief Executive Officer of Polyphonic HMI, Mike McCready, was in the planning stage of launching an AI tool. The artificial intelligence is known as Hit Song Science (HSS).

The said tool is designed to identify the characteristics of current music in relation to past hits. The analysis would be used to determine the potentiality of the current song to become a hit as well.

Mike McCready is looking into which market to target with the new tool. Should he target record companies, producers, or independent artists? And how could he protect his creation from possible future replication?

1. What is the Break-Even point for Polyphonic HMI?

The break-even point for Polyphonic is as follows:

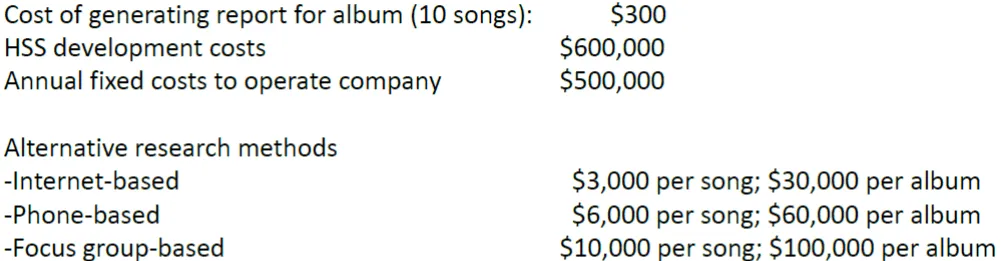

Scenario 1: Recover upfront expenditures in one year and cover ongoing costs at 100% above costs (=$600):

= ($600,000 + $500,000) / ($600 – $300) = 3,700 sold reports to break even

Scenario 2: Recover upfront expenditures in one year and cover ongoing costs at the lowest competitive-parity price (=$30,000):

= ($600,000 + $500,000) / ($30,000 – $300) = 37 sold reports to break even

2. How would you evaluate the Markets for Polyphonic?

ACCORD Model* of New Product adoption applied to Polyphonic HMI Markets

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy