Polar Sports, Inc. - Case Solution

Polar Sports, Inc., a fashion skiwear manufacturing company in Littleton, Colorado is considering switching from seasonal to level production. The vice president of operations is concerned about cost savings, but it will affect other aspects of the company's finances.

Case Questions Answered

- Which factors should Mr. Weir of Polar Sports, Inc. consider in deciding whether to adopt level protection?

- What are the total savings from adopting level protection?

- Prepare pro forma income statements, balance sheets, and cash flow statements to estimate the number of funds required and the timing of the needs under level production. Does Polar Sports need more than $4 million in short-term financing in any given month?

- Think about the concerns of Polar's bank. As the banker, would you be willing to extend the line of credit to more than $4 million for finance-level production? Why or why not?

- What other sources could substitute in part for bank lending if the lender is not willing to extend the present line of credit?

- Compare the liability patterns feasible under the alternative production plans. What implications do their differences have for the risk assumed by the various parties?

- What would be the impact of unsold inventory on cash flows and projected cost savings?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

We have uploaded two case study solutions! The second is not yet visible in the preview.

Introduction – Polar Sports, Inc.

Polar Sports, Inc. is a fashion Skiwear manufacturing business based in Colorado. The company produces high-quality ski jackets, snow pants, sweaters, and thermal softshells, along with accessories.

The Ski apparel design and manufacturing business was highly competitive, causing dollar sales of any product to vary as much as 30% to 40% from year to year, meaning it has become increasingly difficult to accurately predict sales.

Because of this highly competitive market, both design and pricing resulted in short product lives and a high rate of company failures.

The decision Polar Sports, Inc. faces is to change its manufacturing process from seasonal production to level production. Under seasonal production, they greatly expanded their workforce, paying large amounts of overtime as their products required very skilled labor to manufacture their products.

They also incurred significant expenses from hiring and training new employees because of seasonal production. They also paid high maintenance costs because the machines were being operated 15 hours a day.

In developing a pro forma income statement shown in Table 2 for level production, Polar Sports, Inc.’s net income was higher by $388,000.

This can be attributed to the $480,000 reduction by eliminating overtime and reducing maintenance costs and another $600,000 through reduced hiring and training costs.

This decreased the cost of goods sold to 60% of sales rather than 66% under seasonal. While operating expenses increased by $300,000 due to extra charges to store the products.

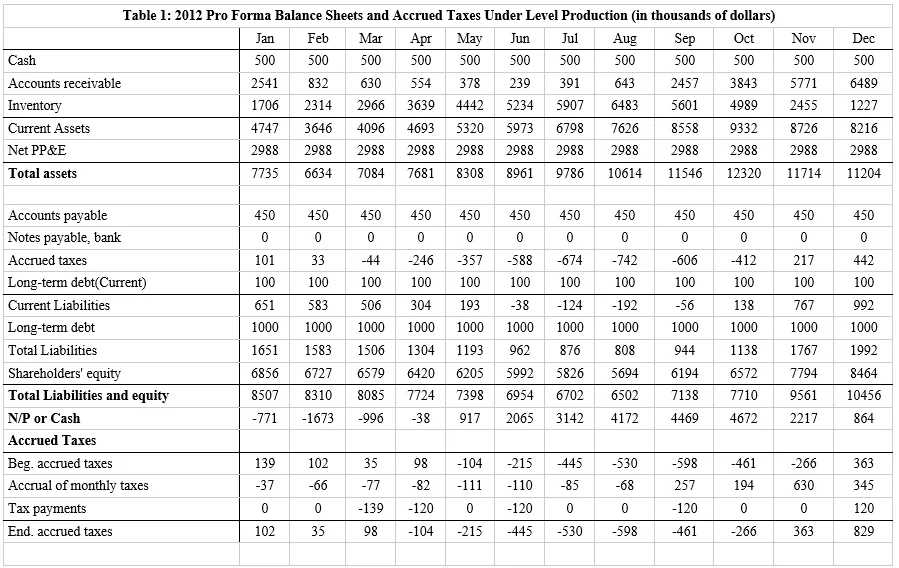

Shown in Table 1 is the pro forma balance sheet under level production. The biggest change is the level of inventory, maxing out in August at $6,483,000 compared to $1,227,000 throughout the year during seasonal production.

Table 1: 2012 Pro Forma Balance Sheets and Accrued Taxes Under Level Production

Also, Polar Sports, Inc. has larger accounts payable and notes payable under level production. The notes payable maxes out in October at $4,672,000, which is higher than the credit limit the bank is willing to extend, but 2/3 of their accounts receivable and inventory is greater than the loan amount, meaning the bank could extend the limit past $4 Million.

Due to the nature of the skiwear market, the large amount of inventory carried under level production may become obsolete. This means that Polar Sports, Inc. may have to…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy