PlanetTran - Case Solution

Seth Riney, the founder of PlanetTran, met with venture capital (VC) firms to discuss opportunities for external funding for the company to expand in other states. The company is engaged in car service for corporations and individuals using hybrid cars. Riney wonders if the acceptance of outside funding and the resulting dilution to the company is worth the return.

Case Questions Answered

- Both Seth Riney, founder of PlanetTran, and the VC agree that it only makes sense to expand to one of the cities.

- Assume that the change in net working capital is 1% of the change in sales.

- Exhibit 6 presents Seth's forecasted cash flows for 2009 for the three potential expansion city strategies: Denver, Chicago, or New York, as well as an organic growth (i.e., no funding) strategy. Seth projects a growth rate of sales of 10% per year following 2009 for each strategy until the end of 2018, followed by 5% thereafter in perpetuity. He assumes all line items will grow at their historical proportions with sales. Assume Seth has a discount rate of 25% and owns 100% of the company. From his perspective, which single strategy is best for the company?

- Exhibit 5 presents the VC's forecasted cash flows for 2009 for the three potential expansion city strategies: Denver, Chicago, or New York, as well as an organic growth (i.e., no funding) strategy. The VC projects a growth rate of sales of 5% per year following 2009 for each strategy in perpetuity. The VC assumes all line items grow at their historical proportions with sales. Assume the VC has a discount rate of 20%. From the VC's perspective, which single strategy is best for the company?

- Which strategy do you think PlanetTran will adopt?

- Assume the role of the venture capitalist. Prepare an offer for the founder. An offer consists of the following. For each of the three expansion strategies (Chicago, Denver, and New York), what fraction of the equity are you

- the VC

- willing to accept in exchange for the required investment?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Seth Riney

Founder

PlanetTran

Dear Mr. Riney,

After conducting evaluations for all expansion strategies based on the perspectives from you and the venture capitalist (VC) firms, we recommend that PlanetTran expand into Chicago.

Valuation from PlanetTran’s perspective

From PlanetTran’s perspective, expansion into New York will be the best strategy among all the options as it is expected to generate the highest valuation and investment return for PlanetTran.

Based on your projection, New York is estimated to gain the highest sales revenue of $25 million in 2009, approximately 3.8 times its organic growth and higher than in Chicago and Denver.

This can be explained by the fact that the industry is concentrated in the major metropolitan areas, and New York alone accounts for 30%–40% of industry revenues.

To assess the three expansion opportunities under your assumptions, we compared the valuation of each project by deducting the required investment cost from the investment value generated.

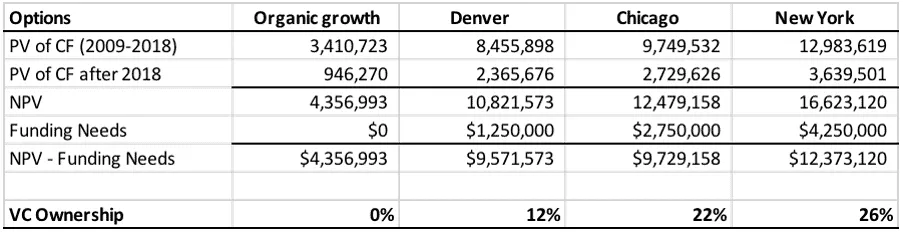

As shown in Exhibit 1, expansion into New York will provide an investment return of around $12.4 million, higher than the valuations of investing in Chicago and Denver, at $9.7 million and $9.6 million, respectively.

Exhibit 1 – PlanetTran’s projection model for future growth

Whichever expansion strategy PlanetTran chooses, the company will be better off than through organic growth.

As for financing needs, the investment in New York will require $4.25 million, meaning that PlanetTran will have to give the VC investors a 26% share of equity, which is the highest among all the options if you choose to issue equity.

Valuation from VC’s perspective

From VC’s perspective, expansion into Chicago is the best choice as it provides the highest valuation for PlanetTran.

A similar valuation approach is adopted based on VC’s perspective.

Expansion into Chicago is estimated to provide the highest sales revenue of $10.3 million in 2009 and expect the highest investment return of $4.7 million, compared to the valuation of expansion into Denver at…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy