Nghe An Tate & Lyle Sugar Co. (Vietnam) - Case Solution

Nghe An Tate & Lyle Sugar Co. is looking to expand its business in Northern Vietnam. Its finance director for international investments, Paul Cooper, applied for financial assistance in the form of a loan from the International Finance Corp. (IFC) for the $90 million sugar mill project. An IFC agricultural specialist by the name of Ewen Cobban was assigned to review the proposal and application. Cobban must look into the viability of the project before making his recommendations.

Case Questions Answered

- Is the mill an attractive investment?

- What are the returns and major risks?

- Will the farmers convert to cane, and will the truckers buy and use their trucks for cane delivery?

- Does the government have an incentive to support the project?

- Would you, as IFC management, finance the project?

1. Is the mill an attractive investment?

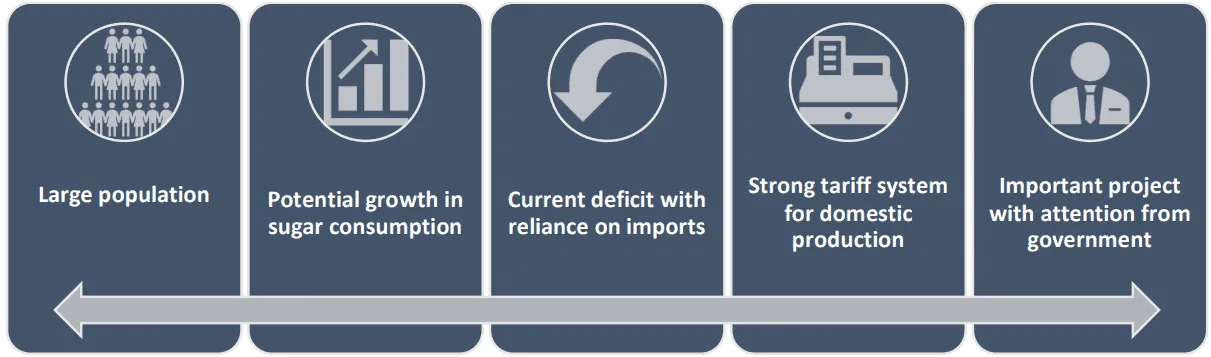

Figure 1 : Reasons why the mill was an attractive investment in Vietnam

Nghe An Tate & Lyle Sugar Co. (NATL) sensed a growing opportunity in the Vietnamese market. They were among the top producers of sugar in the world and looked at this market in Asia with an expansionary roadmap in place. Vietnam was attractive because of the following:

Rising population : The population stood at over 70 million and kept increasing.

The pattern in consumption of sugar : There was a huge potential to grow the demand and consumption of sugar with more development. Though it was 9 kilograms per person consumption of sugar in Vietnam as opposed to 24 kilograms per person in Thailand and 32 kilograms per person in the US, growth was forecasted to be at 15 kilograms per person even for Vietnam.

Current sugar deficit : The country relied on imports, with a deficit being experienced periodically. Thus, this would pave the way to bridge that gap.

Strong tariff system : This would enable bolstering the production of sugar in the domestic ecosystems. This also becomes an additional channel to generate revenues with increased profitability.

Important project from a government perspective : The project could potentially garner a lot of attention from the government due to its sheer scale and importance. This would strengthen and fasten the pace of decision- making.

On weighing different aspects of feasibility and financial viability, confidence from farmer communities who were willing to switch to growing cane also made this an optimistic investment option.

2. What are the returns and major risks?

The risks facing the sugar mill project in Vietnam, as identified by Ewen Cobban, are…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy