Midland Energy Resources, Inc.: Cost of Capital (Brief Case) - Case Solution

Midland Energy Resources, Inc. is a global energy company with operations in oil and gas exploration and production (E&P), refining and marketing (R&M), and petrochemicals. This case study gives the students the opportunity to calculate a company's weighted average cost of capital as a whole and each of its divisions as part of the annual capital budgeting process.

Case Questions Answered

- Discuss the objectives briefly behind estimating the cost of capital used. How, if at all, should these anticipated uses affect the calculations?

- Calculate Midland Energy Resources, Inc.'s corporate WACC. Examine and provide arguments that support your choice of various assumptions and inputs. This discussion should include, but is not limited to, an examination of Capital structure weights, Risk-free rate, Equity market risk premium, beta, cost of equity, tax rate, and cost of debt.

- Should Midland use a single hurdle rate for evaluating investment opportunities for all its divisions? Why or why not?

- Compute the separate cost of capital for the E&P and Marketing and Refining divisions. Why are they different from each other?

- How would you compute the cost of capital for the Petrochemical division?

- Assume a marginal tax rate of 40%.

- What are Mortensen's estimates of Midland Energy Resources, Inc.'s cost of capital used? How, if at all, should these anticipated uses affect the calculations?

- Calculate Midland's corporate WACC. Be prepared to defend your specific assumptions about the various inputs to the calculations. Is Midland's choice of EMRP appropriate? If not, what recommendations would you make and why?

- Should Midland use a single corporate hurdle rate for evaluating investment opportunities in all of its divisions? Why or why not?

- Compute a separate cost of capital for the E&P and Marketing & Refining divisions. What causes them to differ from one another?

- How would you compute the cost of capital for the Petrochemical division?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

We have uploaded two case study solutions! The second is not yet visible in the preview.

The Company – Midland Energy Resources, Inc.

Midland Energy Resources, Inc. is a global energy company operating in the Oil and gas exploration and production (E&P), refining and marketing (R&M), and petrochemicals with a consolidated revenue of $248.5 bn and an operating income of $42.2 bn in 2006.

Uses of estimates of the cost of capital and the effects of the uses on the calculations

Midland Energy Resources, Inc. uses the Cost of Capital estimates for various purposes, including asset appraisals, performance assessments, M&A proposals, and stock repurchase decisions.

The anticipated uses affect the calculations in the following ways:

- The cost of capital needs to be adjusted based on the risk level of the project

- The cost of capital may be calculated on the firm level or individual division/BU level, depending on the project

- It should be adjusted based on the capital structure and the target debt ratio

Midland Energy Resources, Inc.’s Corporate WACC

The WACC is calculated using the following formula:

rd(D/V)(1-t)+ re((E/V)

Where,

rd=Cost of debt=6.6% D/V= Target debt ratio=42.2%

T=tax rate=40% re= Cost of equity= 11.23%

E/V=Target equity ratio=57.8%

WACC = 6.6%(42.2%)*(0.6)+11.23%(57.8%)

WACC = 8.16%

Assumptions

- Capital structure weights: We have used the target debt ratio for the company provided in Table 1 as the basis for calculating capital structure weights.

- Risk-free rate: We have used the 30-year Treasury bond rate to arrive at the risk-free rate, assuming that oil reserves generally have a life ranging between 15-30 years.

- Cost of debt: We have used the spread over the treasury bill of 1.62% above the 30-year rate.

- EMRP: We have used the EMRP of 5% that Midland Energy Resources, Inc. has used in its latest calculations based on various inputs from analysts and consultants.

- Beta: We have used the Beta provided in the case (1.25)

- Cost of equity: We have used CAPM to arrive at the tax-free rate

Please refer to Exhibit 1 for detailed calculations.

Use of a single hurdle rate for all divisions

Midland Energy Resources, Inc. should not use a single hurdle rate for all of its divisions since each of its divisions is different in size, margins, investment terms, capital structure, and risk.

Using a single hurdle rate would assume that all the divisions are similar, which is not the case. We will, in the following sections, calculate the WACC rates of its divisions.

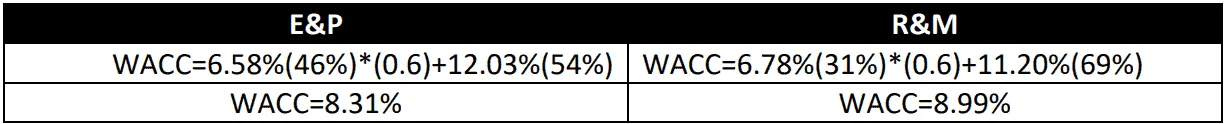

Calculation of WACC for E &P and R&M

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy