MCI Communications Corp.-1983 - Case Solution

Due to increasing competition and in support of its growth, MCI Communications Corp. is in need of external financing. This case study allows students to estimate the amount of external financing MCI requires until the end of 1987.

Case Questions Answered

- Estimate the amount of external financing MCI Communications Corp. requires until the end of 1987 (i.e., the 4-year election period). How much might you expect it to vary? Why?

- Discuss MCI's past financial strategy, paying attention to the types of securities issued. Why do you think that MCI chose each type of financial security at each point in its past?

- Based on your analysis of the outlook for MCI (given the competitive and regulatory nature of the industry), recommend a capital structure policy and defend your decision against plausible alternatives. This is a conceptual (not a numerical) question.

- Assume the following financing alternatives were available to MCI in April 1983:a. Debt issue: $500 million of 20-year subordinated debentures at 12.5% interest.b. Equity issue: $400 million of common stock.c. Convertible debt issue: $ 1 billion of 10-year convertible subordinated debentures at 7.5% interest and a conversion price of $55 per share (=$1,000 face value bond can be converted into 18.18 common shares). MCI Communications Corp. can call the bonds any time after 3 years.

- Which, if any, of these alternatives would you suggest they take? Why?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

External Financing for MCI Communications Corp.

MCI Communications Corp.’s external financing needs to be increased over the years because of industry competition. Therefore, the company should keep investing in its capital to increase its market share and stay competitive as well.

According to Exhibit 3, it is concluded that External Financing = Uses of Funds – Funds from Operation and exclude the data in Exhibit 9, which is not included in Exhibit 3.

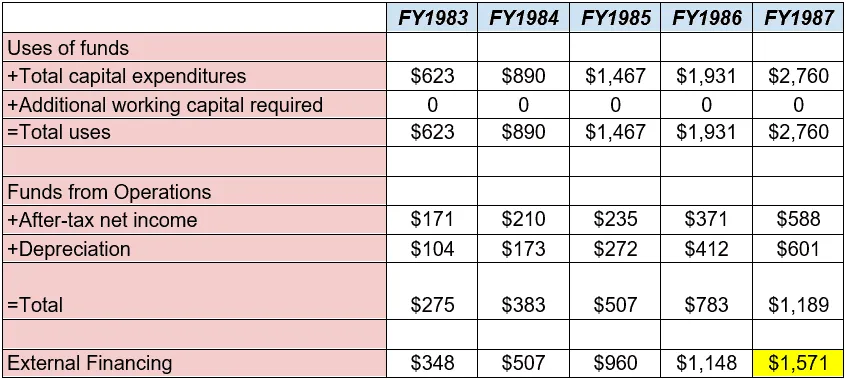

We get External Financing = Total capital identified + Additional working capital required -after-tax net income – Depreciation. We can then calculate the External Financing needed for FY1987 is $1,571 based on data in Exhibit 9 through this formula. (Table 1)

Table 1

On the other hand, we also need to consider the good and bad conditions to decide the range of MCI External Financing needed in FY1987.

In Exhibit 9B, we know that:

- Access charges will decrease to around 26.5%, and due to MCI’s competitor AT & T paying 50% Access charges, we assume that Access charges are 26.5% in good condition and 50% in bad condition.

- The operating profit margin is expected to recover to 15%. Thus, we assume the margin will increase by 7% and result in a 22% margin in good condition. In bad conditions, we assume that margins will be reduced by 7%, and the margin will be 8%.

- For other income, under bad conditions, with the consumption of excess cash, this number is expected to drop to 3 million dollars. In good condition, MCI Communications Corp. may still retain 4 million dollars.

- Provision for taxes, under good conditions, will always remain at 25%. On the contrary, under bad conditions, the tax rate will be equal to the base tax rate of 46%.

- The incremental investment factor, under good conditions, will be reduced to $1 dollars, which also shows the cost reduction. In bad condition, it will remain at $1.15 dollars.

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy