M&M Pizza - Case Solution

M&M Pizza, a premium pizza producer in Francostan, recently appointed Moe Miller to manage their company. Miller needs to examine the results of the recapitalization, considering the new government corporate tax law. This case study provides an analysis and valuation of M&M Pizza's capitalization.

Case Questions Answered

- How do the financial statements for M&M Pizza vary with the proposed repurchase plan? Do alternative policies improve the expected dividends per share?

- What impact does the repurchase plan have on M&M's weighted average cost of capital?

- What are the debt and equity claims worth under alternative scenarios? You may note that the present value of a perpetual cash flow stream is equal to the expected payment divided by the associated required return.

- Which proposal is best for investors? What do you recommend that Miller will do?

- How would your analysis in questions 2 and 3 and recommendation in question 4 change if the new tax law is implemented? Please note that, with corporate taxes, the expected debt-to-equity ratio under the share repurchase plan is 0.588, and the number of remaining shares outstanding is 39.4 million.

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not yet visible in the preview.

Executive Summary – M&M Pizza

M&M Pizza, a premium pizza producer in Francostan, recently appointed Moe Miller to manage their company. Miller decided to recapitalize the balance sheet since he thought that the company was overly conservative, explained by the flat stock price for a year, although the firm generates strong and steady profitability per year.

Consequently, he decided to issue debt for F$500 million and use these proceeds to repurchase F$500 million shares. Therefore, he needs to examine the results of this recapitalization, considering the new government corporate tax law.

This report provides an analysis and valuation of M&M Pizza’s capitalization. To determine the firm’s value, it is important to consider the capital structure and other factors that impact the firm’s value and shareholders’ wealth.

Using financial theory to analyze each scenario, the share price did not change in some cases, and WACC (weighted average cost of capital) also remained constant in almost all scenarios, except in levered firms with corporate tax, assuming no growth in dividend per share and applying Gordon growth model to compute the valuation.

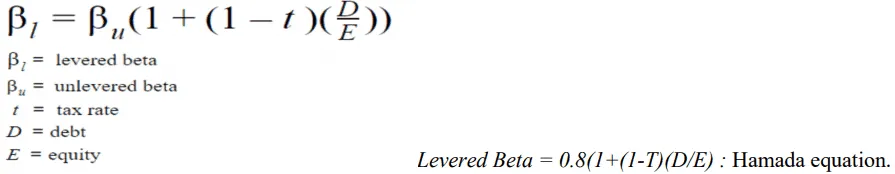

In addition, the debt-to-equity ratio and the tax rate are applied to compute M&M Pizza’s levered beta since the levered beta varies with these inputs. As a result, considering corporate tax in a levered firm, WACC (weighted average cost of capital) is equal to 7.41%, lower than the unlevered firm’s WACC (8%).

In particular, we assume M&M Pizza’s dividend growth rate is zero because of an unchanged event in the country. Lastly, implementing the corporate tax (20%) is favorable for the levered firm due to tax shield benefits. This makes the share price become higher, compared to the unlevered firm with tax.

M&M Pizza, a pizza producer in Francostan (a small country of 12 million population with stable economic conditions), is concerned about financial performance, which affects shareholders’ wealth.

Moe Miller was appointed as a director to manage the company through recapitalization in order to verify and compare the result of each scenario based on the calculation and financial theory.

M&M PIZZA’s performance

From the financial statement( Exhibit 1), M&M Pizza started financing with a debt of 500 million and repurchasing the shares. The total shares outstanding is decreased by 20 million (from 62.5 million to 42.5 million). As a result, the dividend per share is increased by 0.47 to compensate shareholders for bearing higher risk.

First, unlevered situation (pure equity financing), the market value of the firm is exactly the same as the value of equity, calculated by the share prices (25) multiplied by the number of shares outstanding (62.5).

Second, in a levered scenario, the firm issues $500 million for debt financing. Since a firm’s total market value is independent of its capital structure (F. Modigliani and M. Miller, 1958), the value of equity is the difference between the total firm value and the debt value, which is equal to 1062.5 million.

The firm’s cost of equity, calculated by CAPM in Exhibit 4, is increased due to the leverage (an increase in DE ratio) since the levered beta (β) is varied with the DE ratio, ignoring the corporate tax in the Hamada equation.

On the other hand, according to Modigliani-Miller Proposition II, the expected return on equity is also increased with a D/E ratio.

Noted DE ratio: debt to equity ratio

Regarding the dividends in a levered scenario, as the DPS (dividend per share) increases…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy