Kiwi Transportation Company - Case Solution

A 2nd generation leader must evaluate new opportunities for the business to maintain profitability. This case study focuses on a unique urban ferry and tour boat operator, the Kiwi Transportation Company. Its new CEO is looking into various routes to reversing the trend of decline in profits. Students are encouraged to develop an analytic model and consider the stakeholder impacts of different strategies.

Case Questions Answered

- What were the budgeted profits for 2016 for the Kiwi Transportation Company? What were the actual profits? What was the overall variance in profits? Did the company overall perform better or worse than expected?

- Compute total master budgets and actuals for revenues, variable manufacturing costs, variable selling and admin costs, fixed manufacturing costs, and fixed selling and admin costs. Which line items were responsible for the overall profit variance?

- Compute flexible budgets for revenues, variable manufacturing costs, variable selling and admin costs, fixed manufacturing costs, and fixed selling and admin costs.

- Compute the selling price and volume variances for revenues.

- Compute volume variances and combined price/efficiency variances for variable costs.

- What is the volume variance for fixed manufacturing costs?

- Kiwi has two responsibility centers: production and sales. Production is responsible for efficiently purchasing and producing the necessary amount of production. Sales are responsible for pricing and, therefore, the amount sold, as well as for controlling selling and administrative costs. Which combination of variances would you use to evaluate the two departments? Which variances would you view as uncontrollable? Each year, a cash bonus of $1,000 per person is paid to all the individuals in the department (production or sales) who perform most above expectations. Which department will receive the 2016 bonuses?

1.) What were the budgeted profits for 2016 for the Kiwi Transportation

Company? What were the actual profits? What was the overall variance in profits? Did the company overall perform better or worse than expected?

Kiwi Transportation Company

Budgeted Profits for 2016

10,000 cars * $5,000 = $50,000,000

Actual Profits in 2016

11,000 cars * $4,800 = $52,800,000

Overall Variance in Profits

$50,000,000 – $52,800,000 = $2,800,000

Overall, the Kiwi Transportation Company performed better than expected. Their actual profits were $2,800,000 greater than their budgeted profits.

Even though the cars sold for $200 less than budgeted, the company ended up selling 1,000 more cars than budgeted, which increased their profits.

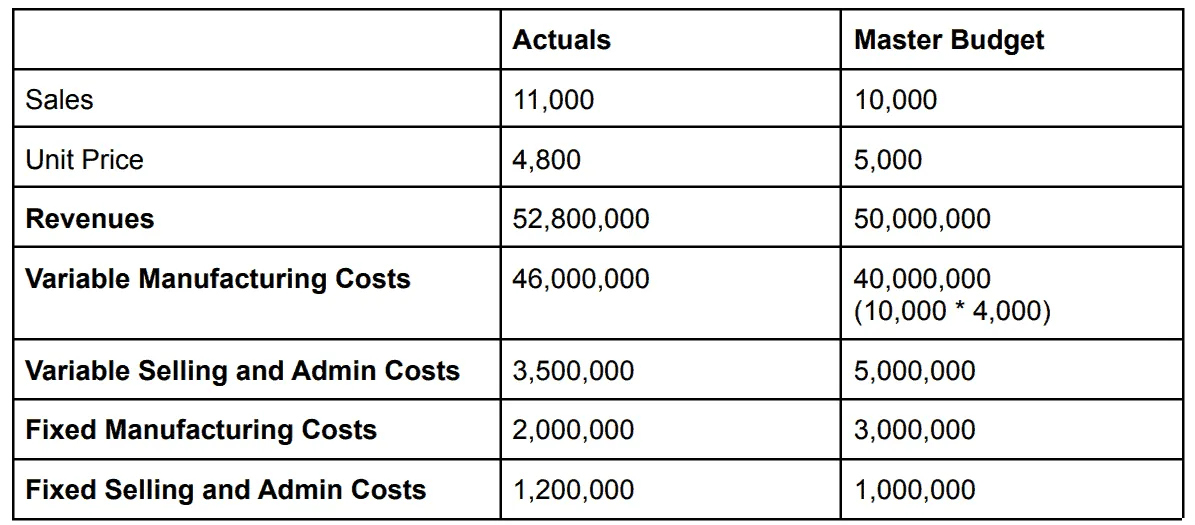

2.) Compute total master budgets and actuals for revenues, variable

manufacturing costs, variable selling and admin costs, fixed manufacturing costs, and fixed selling and admin costs. Which line items were responsible for the overall profit variance?

Line item (b) Variable Manufacturing Costs is responsible for overall profit variance.

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy