J&L Railroad - Case Solution

A railroad industry is dependent on its regulatory conditions. Because of this, J&L Railroad's income growth is affected by diesel fuel prices in the market. Thus, this case study discusses some hedging alternatives and presents a computation of how much percentage of foreseen fuel demand is to be hedged as well as the process to be undertaken for it to be hedged.

Case Questions Answered

- Should J&L Railroad hedge all of its exposure to diesel fuel? What percentage of the 17.5 million gallons per month would you hedge? How did you arrive at this percentage?

- What are the pros and cons of using NYMEX contracts versus using the risk-management products offered by Continental Bank? Is the use of a monthly average price a net advantage or disadvantage to J&L? How can Continental hedge its side of the deal?

- Using the estimate of 17.5 million gallons per month, how would you construct a futures hedge for the following 12 months? How would you construct a commodity-swap hedge?

- Should Craft consider using an option-based hedge, i.e., caps, floors, collars, or corridors? Would you recommend that he reduce his overall hedging cost by using a collar or corridor? What strike prices should you use? Provide graphic illustrations.

Agenda

Should J&L Railroad hedge all of its exposure to diesel fuel? What percentage of the 17.5 million gallons per month would you hedge? How did you arrive at this percentage?

What are the pros and cons of using NYMEX contracts versus using the risk- management products offered by Continental Bank? Is the use of a monthly average price a net advantage or disadvantage to J&L? How can Continental hedge its side of the deal?

Using the estimate of 17.5 million gallons per month, how would you construct a futures hedge for the following 12 months? How would you construct a commodity-swap hedge?

Should Craft consider using an option-based hedge, i.e., caps, floors, collars, or corridors? Would you recommend that he reduce his overall hedging cost by using a collar or corridor? What strike prices should you use? Provide graphic illustrations.

1. Should J&L Railroad hedge all of its exposure to diesel fuel?

How did we proceed?

Objective : the aim is to determine the proportion of the exposure that should optimally be hedged.

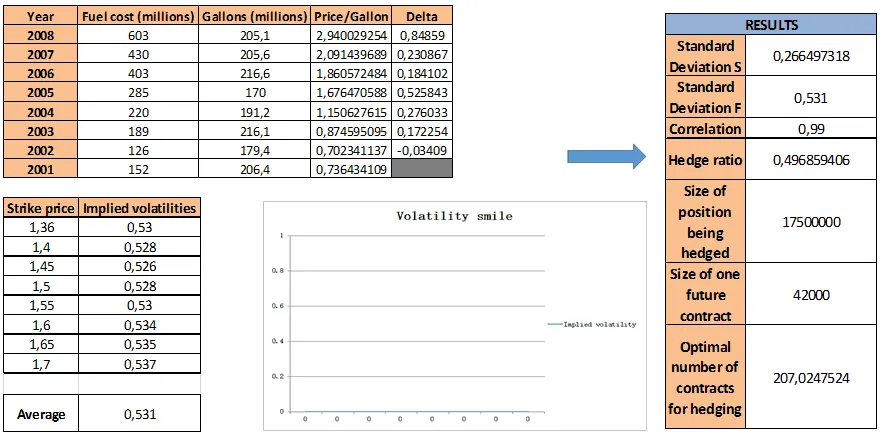

Optimum hedge ratio (minimum variance). What we need to calculate is:

- The standard deviation of the change in spot price during the hedge period;

- The standard deviation of the change in future price during the hedging period (as the correlation between Heating Oil and Diesel Fuel prices is very high (0,99), it is possible to hedge the company’s fuel exposure thanks to Heating Oil Futures Contracts);

- Coefficient of correlation between the change in spot price and the change in futures price.

Our results

- Since the oil market is facing a crisis in demand, we decided to hedge about 50% of our exposure.

- The reason why we made this choice is that we want to avoid hedging more than how much we will purchase.

- Our decision, moreover, is supported by the data in the following slide.

1. What percentage of the 17.5 million gallons per month would you hedge? How did you arrive at this percentage?

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy