IBET Pension Fund - Case Solution

This IBET Pension Fund case study provides a valuation of the properties and presents a recommendation for a strategy of managing the portfolio.

Case Questions Answered

- Determine the value of each property.

- Provide valuation analysis.

- Make a recommendation on whether to hold, buy, or sell the property.

- Write a 2-page memorandum and suggest a strategy for managing the portfolio.

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

MEMORANDUM

**To: Board of Trustees

**Subject: Recommendation for IBET Pension Fund Portfolio Strategy

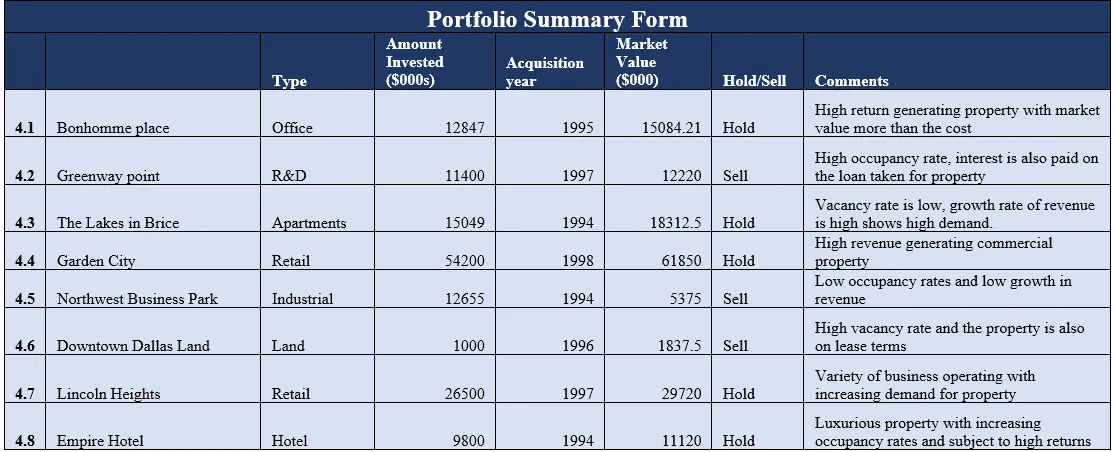

The portfolio strategy is drafted based on the portfolio summary table prepared in order to determine which properties are performing well in the portfolio and which property is performing poorly so that a suitable strategy for managing the property can be introduced to maximize the benefit for the beneficiary of pension funds.

The market value of the properties is determined based on the income approach method in which the cash flow from operations is taken in the numerator, and the capitalization rate is taken as the denominator to determine the potential market value of the property according to the cash flows generated by the particular property.

According to the strategy of portfolio summary, various properties are subject to…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy