Husky Injection Molding Systems - Case Solution

Husky is a producer of injection molding systems based in Canada. Ever since its inception, the company enjoyed strong growth and profit as it produces excellent performance systems. However, competitors start emerging and the company experienced a decline in profits. Its CEO and founder Robert Schad must come up with a plan to defend the company. Should the company retain its traditional market or should it expand beyond it?

Case Questions Answered

- Is there a willingness to pay for the Husky Injection Molding Systems? In other words, are they worth the price the company charges? Please calculate a dollar value of how much more you are willing to pay for a Husky Injection Molding PET machine compared to the machine of a major competitor.

- Given the recent crisis, what should Husky's next steps be? Be specific and discuss possible drawbacks.

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

1. Is there a willingness to pay for the Husky Injection Molding

Systems? In other words, are they worth the price the company charges? Please calculate a dollar value of how much more you are willing to pay for a Husky Injection Molding PET machine compared to the machine of a major competitor.

Husky Injection Molding Systems PET machine customers are more sophisticated than B2C customers and make extensive calculations when comparing vendors/systems.

Four main elements can affect customers’ willingness to pay for PET machines. These elements are:

- Incremental productivity costs

- Incremental raw material costs (resin cost)

- Incremental electricity consumption costs

- Incremental rent costs due to increased floor space

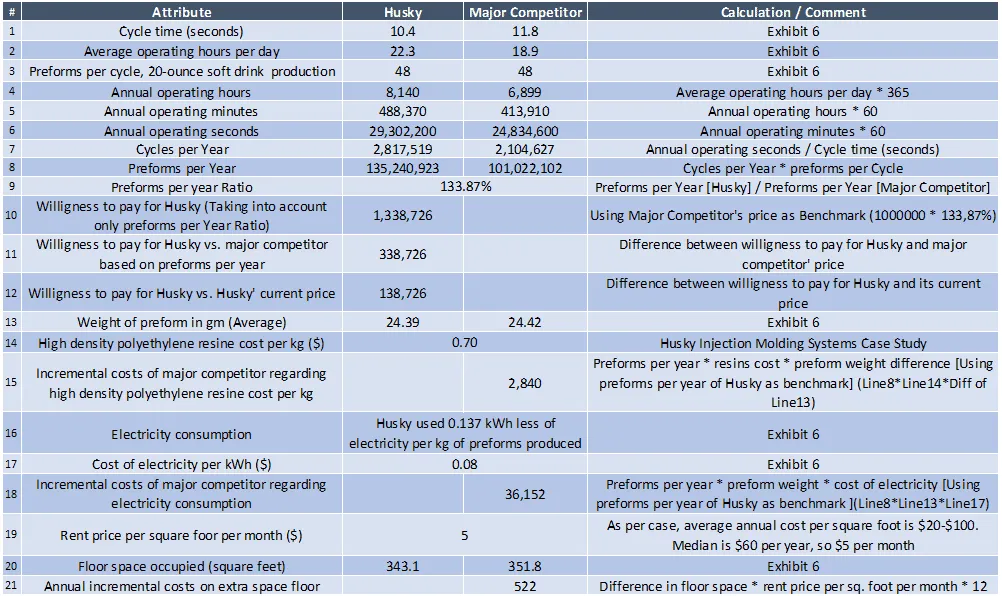

Husky’s PET machines are characterized as more productive. They conduct 33,87% more preforms per year than the main competitor (Line 9 of Figure 1) due to their shorter cycle (1.4 seconds less – Line 1 of Figure 1).

This means that to produce the same number of preforms, B2B customers need one Husky system or an equivalent of 1,34 systems of a major competitor.

Also, Husky’s final product is lighter (0,03 gm – Line 13 of Figure 1) and consumes less electricity (Line 16 of Figure 1). Moreover, the required floor space is 8.7 square feet less than the major competitor (Line 20 of Figure 1).

As a result, to make the same preforms with Husky Injection Molding Systems, customers of a major competitor had incremental costs regarding resins, electricity, and rent.

These incremental costs have been calculated in lines 15, 18, and 21 of Figure

- Customers’ willingness to pay is $1,378,240 (Figure 2). This amount is 37.8% higher than the major competitor and 14.9% higher than Husky’s current price (Figure 3).

Figure 1: Calculations, Comments, and Sources

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy