Hill Country Snack Foods Co. - Case Solution

As a manufacturer of frozen treats and other snack food products, Hill Country Snack Foods Co. has been practicing risk-aversion by keeping tight control over expenditures in operating the business. As the CEO of this Texas-based company is retiring in the near future, investors are speculating on whether the company will employ a more aggressive approach in its capital structure. This case study analysis allows students to analyze the company's present capital structure and provide alternatives that it may explore in the future.

Case Questions Answered

- Make a recommendation to the CEO, Howard Keener, on whether Hill Country Snack Foods Co. should issue debt or reduce its excess cash to repurchase shares. Provide a clear data-based recommendation to Keener.

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Recommendation of Debt to Capital Structure (Hill Country Snack Foods

Co.)

To Mr. Howard Keener,

To achieve our vision of maximizing shareholder value, we should increase the proportion of debt financing. Thus, I recommend that Hill Country Snack Foods Co. take a 40% debt-to-capital structure.

The absence of debt and a large portion of the equity has decreased the rate of return. If we bring debt into the capital structure, it increases the return on equity. Higher returns on shareholders should, therefore, rely more on debt than equity.

Rationale:

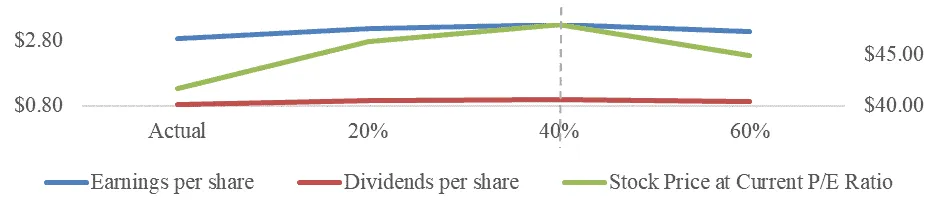

As shown in the table below, by restructuring the debt-to-capital ratio to 20%, 40% debt-to-equity ratio, and 60% debt-to-equity ratio, the earnings per share increased from $ 2.88 to $3.19, $3.33 and $3.13.

Similarly, the dividend per share also increased from $0.85 to $0.96, $0.99, and $0.92. It can be seen that when the ratio is 40%, both the earnings per share and dividends per share reach peak values.

The motive of Hill Country Snack Foods is to maximize shareholders’ wealth, whereas the CEO and the management hold approximately 16% of the shares. Due to debt with an increase in both earnings per share and dividend per share, the performance will be in line with the objective.

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy