Hershey Foods Corporation: Bitter Times in a Sweet Place - Case Solution

In the summer of 2002, Hershey Foods Corporation reached a decision of going into a potential sale. Within months, the corporation received offers and was examining two of them: Cadbury Schweppes PLC and Nestle S.A. through a joint bid and Wm. Wrigley Jr. Company by an independent bid. Hershey's Board is faced with making the final decision. It has to consider the value of Hershey in contrast with the offered bids. The board is also contemplating on whether the planned sale would constitute a breach of their mandate from Milton Hershey.

Case Questions Answered

- Conduct a sensitivity analysis for the cash flow of Hershey Foods Corporation. What are the key drivers of the cash flow?

- Calculate Hershey's valuation under management forecasts.

- Evaluate the offers and assess associated risks.

- What's your recommendation?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Executive Summary – Hershey Foods Corporation

Hershey’s cash flow key drivers (Exhibit 2)

After conducting a sensitivity analysis, we believe the cost of sales and SG&A are the factors that contribute most to Hershey Foods Corporation’s cash flow. In addition, the Sales growth rate and Cost of capital (Exhibit 1) have a moderate impact on the value of Hershey’s cash flow as well.

Hershey Foods Corporation stand-alone valuation under management

forecasts (Exhibit 3)

Under management forecasts, Hershey’s share is valued at $102, which is much higher than the market value before acquisition news ($63) and the two offers (Wrigley: $89 – NCS: $75), suggesting that the Trust should drop the two offers.

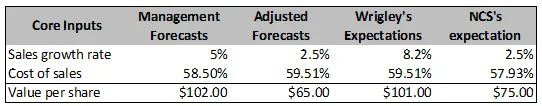

We believe the significant difference between share value and market value is because Hershey’s management is being over-optimistic in their forecasts, especially in Sales growth rate (5%) and Cost of sales (58.50%).

Hershey’s financial performance from 1996 – 2001 reveals that the averages of sales growth rate and cost of sales are 0.96% and 59.51%, respectively, making management forecasts’ inputs unreasonable.

Furthermore, the cost of sales in 2001 was significantly higher than in previous years (64.50%), and Hershey Foods Corporation was experiencing a decrease of nearly 2% in sales.

Considering Hershey’s historic performance, along with the declining trend in the confectionery industry & market conditions, we don’t think Hershey’s management forecasts reflect the firm’s future accurately in this case.

To further prove our point, we conducted an adjusted stand-alone valuation for Hershey based on historical performance (Exhibit 4). Hershey’s share under this adjustment is valued at $65, which is much closer to the preannouncement current market value of $63.

We believe this price reflects Hershey’s share value better than management forecasts. Also, using this value, both offers are considered appealing, and therefore, the Trust should continue to evaluate each offer.

Wrigley & NCS’s offers evaluation

In Wrigley’s case (Exhibit 5), we adjusted the cost per share to better reflect the potential risk of losing the $1 billion licensing agreement with Nestlé. The actual cost per share for Wrigley would now increase from $89 to $101, implying that Wrigley would have to expect a required sales growth rate of 8.2%.

Wrigley’s high projected growth rate for Hershey, compared to the current average rate of 0.96%, mainly results from the expectation of selling Hershey’s products internationally.

However, since there are a lot of uncertainties and risks involved in international market penetration, we believe Wrigley is…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy