Conflict on a Trading Floor (B) - Case Solution

This Conflict on a Trading Floor (B) case study supplements the (A) version of this case. It discusses the options available to a protagonist who was subjected to a difficult situation which would be a test of her work ethics.

Case Questions Answered

- Take the viewpoint of the unnamed main character (protagonist) in this "Conflict on a Trading Floor (B)" case. What are the stakes for him in this situation, meaning what could he gain and what could he lose?

- What options are available to him?

- Which option would you choose?

Executive Summary – Conflict on a Trading Floor (B)

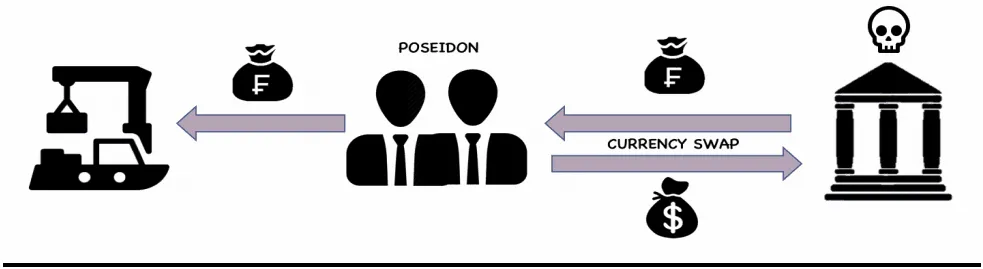

Conflict on a Trading Floor (B) case study tackles FirstAmerica Bank and its client, “Poseidon Cruise Lines,” which wanted to finance the construction of its new cruise ship. Linda worked as a top salesperson at FirstAmerica Bank, and her assistant was responsible for making a deal with Poseidon and constructing a strategic plan.

Chiefly, this plan consists of a cross-currency swap and long-term payment in an agreement. Due to the close relationship between Linda and the CFO of Poseidon, she convinces them not to “shop” the deal as it would suddenly increase Poseidon’s cost. The CFO, without strong financial understanding, agreed to Linda’s plan.

However, Linda’s assistant was aware of her actions and her doubtful method of conducting business. She dramatically exaggerated the need for secrecy about the transaction. Moreover, her quoted interest rates were much higher than the rate that traders require to hedge profitably.

Furthermore, after the assignment to fax over the misleading data, Linda was observed by her assistant. Given these points, it can be said that the assistant needs to look thoughtfully and evaluate the issues he could take from the situation, whether to send or not to send the fax.

This report will show the analysis and evaluation of the course of action according to the standards of ethics and apply a basic framework covering ethical standards or norms.

As a result, the recommendation is made. To clarify more, he should stand on long-term credit represented by the result of the framework process.

Overview & Problem

Linda, a top salesperson at FirstAmerica (FA) Bank, was now working on a $700 million dollar financing project for her client, Poseidon Cruise Lines.

The deal was so complicated that it involved much complex currency exchange and long-term payments. She convinced the treasurer and CFO of the Poseidon Cruise Lines not to shop the deal since it could lead to more costs of doing this deal.

At that time, an unnamed protagonist in the case acts as the assistant of Linda. He starts questioning Linda’s approach to conducting business and ethics because she dramatically exaggerates the need for secrecy in the transaction.

Moreover, the quoted interest rate in Linda’s paper is doubtfully high, resulting in an abnormally high profit for FirstAmerica Bank.

Also, she misleads Poseidon Cruise Line to convince that the bank would profit only $1.2 million while a fee of roughly $12.5 million that Linda charged from the client was roughly $12.5 million.

Consequently, Poseidon Cruise Lines began to doubt how Linda…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy