Classic Pen Co.: Developing an ABC Model - Case Solution

Classic Pen Co. has moved into the business of producing new specialized colors besides its core blue and black pen. However, it experienced a decreasing margin on the blue and black pens and a rising cost. Seeking an explanation for such problems, the company studied its activity-based costing (ABC).

Case Questions Answered

- Case Overview

- Inspection

- ABC System Diagram

- Key Findings & Analyses

- Compute the profitability of each of the pens using Traditional Absorption Based Costing, then Activity-Based Costing.

- Identify the main causes of the difference in profitability emerging from the ABC analysis (compared to traditional costing).

- What are the likely implications of this finding for managerial decision-making?

- What strategic options does the company Classic Pen Co. have to address the problems revealed through the ABC analysis?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

You will receive access to two case study solutions! The second is not visible in the preview.

Case Overview – Classic Pen Co.: Developing an ABC Model

Classic Pen Co. is a low-cost pen-producing company that traditionally produces blue and black pens with a profit margin of over 20%. About 7 years ago, the sales manager saw growth opportunities in colored pens and thus introduced red and purple into their product line, which was sold at a premium.

Unfortunately, this strategy, which otherwise should be driving profitability, is now exhibiting an overall decline in profits as per the financial results. The flagship products’ margins also seem to be dipping, which compelled us to review the income statement from an activity-based lens.

Inspection:

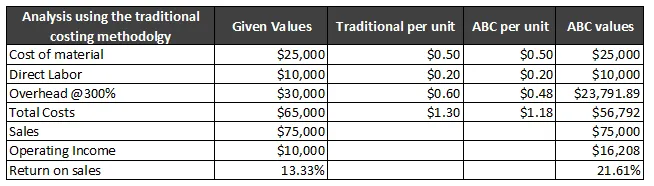

As a starting point of the investigation, we derived the cost price per pen in the traditional income statement format, which was currently used by Classic Pen Co.

Traditional Income Statement

| Blue | Black | Red | Purple | Total

Revenue | $75,000 | $60,000 | $13,950 | $1,650 | $1,50,600

Material costs | 25,000 | 20,000 | 4,680 | 550 | 50,230

Direct Labour | 10,000 | 8,000 | 1,800 | 200 | 20,000

Overhead @ 300% | 30,000 | 24,000 | 5,400 | 600 | 60,000

Total Costs | 65,000 | 52,000 | 11,880 | 1,350 | 1,30,230

Total operating income | $10,000 | $8,000 | $2,070 | $300 | $20,370

Volume | 50,000 | 40000 | 9000 | 1000 | 100000

Selling Price / Unit | 1.5 | 1.5 | 1.55 | 1.65 | 1.506

Cost Price / Unit | 1.3 | 1.3 | 1.32 | 1.35 | 1.3023

Return on sales | 13.3% | 13.3% | 14.8% | 18.2% | 13.5%

The traditional cost prices of the pens were as follows:

- Blue – $1.3

- Black – $1.3

- Red – $1.32

- Purple – $1.35

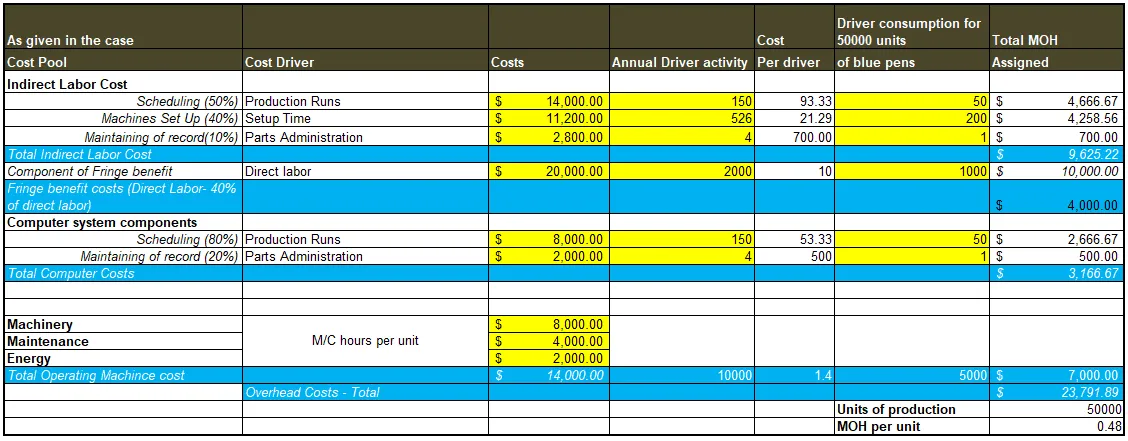

Using the activity-based costing method, we then calculated the revised product costs for each of the pens produced by Classic Pen Co. with the information collected by Dempsey.

Calculations for Total Indirect Costs | |

---|---|---

Fringe benefits | $16,000.00 |

Direct labor | $20,000.00 |

Indirect labor | $20,000.00 |

Total Indirect labor | $28,000.00 |

[Divided the fringe benefits as per the weightage between direct labor and indirect labor]

Classic Pen Co. Blue Pens:

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy