Butler Lumber Co. - Case Solution

The Butler Lumber Co. is looking into taking out a bank loan for business expansion. This case study provides students the opportunity to look into the financial statements of a company and prepare financial forecasting and analyze the same.

Case Questions Answered

- Why does Mr. Butler have to borrow so much money to support this profitable business?

- Do you agree with his estimate of the company's loan requirements? How much will he need to borrow to finance his expected expansion in sales (assume a 1991 sales volume of $3.6 million)?

- As Mr. Butler's financial adviser, would you urge him to go ahead with or reconsider his anticipated expansion and his plans for additional debt financing?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Financial Statements for Butler Lumber Co.

The following FINANCIAL STATEMENTS include our 1991 forecast for Butler Lumber Co.

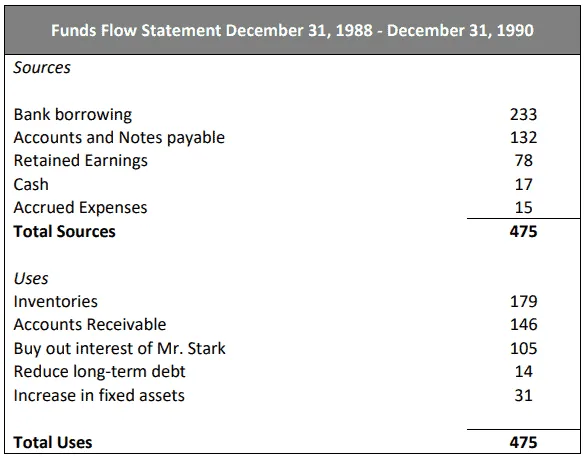

Funds Flow Statement

Income Statement

…

Balance Sheet

…

1. Why does Mr. Butler have to borrow so much money to support this

profitable business?

Mr. Buttler wants to expand his business. For the expansion of the company, he needs extra funding to support his business operation.

Current sources of funding are coming from Bank Borrowing (49%) and Note Payables (28%), but his cash is tied up in Inventories (38%) and Accounts Receivables (31%).

Furthermore, he bought out his partner, Mr. Stark. By doing this, he incurred an additional cash outflow of 105k (22%).

Besides the fact that he is expanding the business, we have to see whether he is running the business efficiently.

Regarding his inventory management, we see a decreasing inventory turnover since 1988, which means that his inventory for Butler Lumber Co. is piling up.

We know, however, that this might be partially due to the fact that he is taking advantage of discounts on bulk purchases. This implies that there is a…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy