B.F. Goodrich-Rabobank Interest Rate Swap - Case Solution

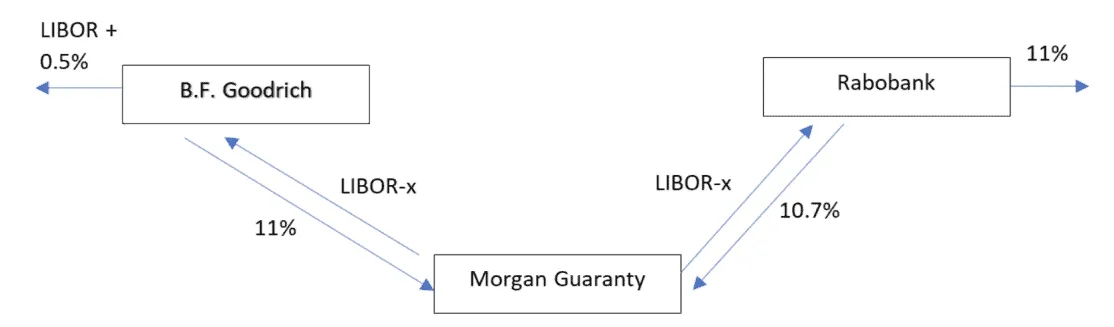

Case study on B.F. Goodrich, a U.S. manufacturing company, and Rabobank, a Eurobank, wherein these two firms swapped fixed and floating rate obligations as part of their strategies to reduce their financial expenses.

Case Questions Answered

- How large must the discount (X) be to make this an attractive deal for Rabobank?

- How large must the annual fee (F) be to make this an attractive deal for Morgan Guaranty?

- How small must the combination of F and X be to make this an attractive deal for B.F. Goodrich?

- Is this an attractive alternative for savings banks?

- Is this a deal where everyone wins? If not, who is the loser?

Background Information – B.F. Goodrich-Rabobank Interest Rate Swap

The 1982 recession left numerous businesses in financial distress. B.F. Goodrich experienced difficulties as its credit rating was demoted from BBB to BBB-. The following year, B.F. Goodrich was desperate for $50 million to finance their existing operations. Goodrich was initially faced with a dilemma.

The high interest, coupled with Goodrich’s subpar credit rating, resulted in unappealing borrowing terms. Goodrich was adamant about accepting terms that allowed them to borrow long-term with a fixed rate.

Thus, in 1983, B.F. Goodrich and Rabobank accomplished two financings and an interest rate swap. Unlike B.F. Goodrich, Rabobank had a perfect credit rating of AAA.

Furthermore, Rabobank was looking to reduce its borrowing costs through a floating rate. This mutually beneficial transaction was aided by Morgan Guaranty, who served as an intermediary guarantor for the swap agreements.

Size of Discount (X)

For this deal to be attractive for Rabobank, it needs to bring in a positive net flow of capital by receiving higher interest rates while paying lower interest rates. With an 8-year fixed receipt of $5.5 million from Morgan Guaranty, Rabobank would receive $2.75 million semiannually from Morgan.

Thus, simplified to a yearly basis, we can calculate $50 million times LIBOR minus the required percentage of discount for this to be an attractive deal for Rabobank and set this equal to the yearly payments of $5.5 million.

With a LIBOR stated at 8.75%, we can simplify these calculations to (0.0875-X) < 0.11, with 0.11 resulting from the $5.5 million yearly payment divided by the total of $50 million.

Therefore, for this to be an attractive deal for Rabobank, the total value of the discount X must exceed 2.25%, a discount obtained by solving the equation for X.

(0.5) * (50 mil) * (LIBOR-X) =

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy