Apple Inc. in 2015 - Case Solution

"Apple Inc. in 2015" case study deals with the company as having seen and created the growth of many technological breakthroughs in the past two decades. The company hosts a limited range of products for its consumers, yet Apple is an enormous multi-billion-dollar company. However, much of the growth and profits of the company are highly reliant on the iPhone. Apple is struggling to find products besides the smartphone to generate high growth and profits. The criteria that will be used to evaluate the alternatives are brand image, profitability, and customer satisfaction. The alternatives are vertical integration, a home security acquisition, and a laser projection keyboard.

Case Questions Answered

- Please perform 5F analyses of both the personal computer industry and the smartphone industry on the basis of the information given in the case. Include these analyses in your report as Appendices.

- Perform a SWOT analysis of Apple Inc in 2015. Again, please include the analysis in your report as an Appendix.

- What advice would you offer the new CEO, Tim Cook? Was the launch of the Apple Watch a good idea? Suggest three possible courses of action that may maximize stakeholder value for Apple under his leadership, and indicate the one which, in your opinion, is most likely to succeed.

- Discuss Apple, Inc.'s strategy and how the company executed it.

- Provide your recommendations on how the company can better improve and avoid downfalls.

You will receive access to two case study solutions! The second is not yet visible in the preview.

Apple Inc. in 2015 Case Study Overview

This “Apple Inc. in 2015” case study deals with the company as having seen and created the growth of many technological breakthroughs in the past two decades.

The company hosts a limited range of products for its consumers, yet Apple is an enormous multi-billion-dollar company. However, much of the growth and profits of the company are highly reliant on the iPhone.

Apple is struggling to find products besides the smartphone to generate high growth and profits. The criteria that will be used to evaluate the alternatives are brand image, profitability, and customer satisfaction. The alternatives are vertical integration, a home security acquisition, and a laser projection keyboard.

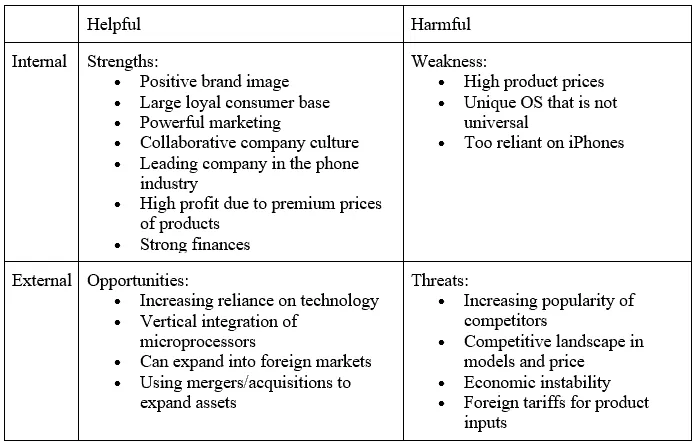

Appendix 1. SWOT Analysis

The first alternative is that Apple can gradually move away from purchasing processors and microprocessors for their phone, computer, laptop, and tablet products and engage in vertical integration.

The first advantage is that vertical integration will save Apple money from buying processors from Intel. In exhibit 4, there were 120.5 million Intel- Mac-installed base units in 2014. Thus, if Apple vertically integrated processors, it can reap more profits and continue to demonstrate its brand image.

The second advantage is that Apple can create even more differentiation within a competitive phone industry. By developing its own processor, Apple can raise the prices of its products because its products have a processor unique only to Apple.

Another advantage is that Apple can create even higher entry barriers into the phone market because companies will be held to a standard compared to Apple, and companies are expected to create a new processor like Apple.

However, the first drawback is that Apple has been using it since 2005. Therefore, the transition of using Intel for 10 years will be tedious because the number of inputs from the supplier will be much less than the process of producing processors.

The second disadvantage is that Apple has historically proven that its own processors implemented in its products were not successful. Apple’s gross profit margins were lower without Intel than with Intel (Exhibit 5).

The third disadvantage is there will be less flexibility in Apple Inc. The vertical integration of processors will disrupt the streams of investments the company is engaged in, therefore reducing efficiency and profitability.

The second alternative is that Apple can acquire a smart home security company, Nest, and add Apple features, like Siri, to the product.

The first advantage is that there are limited alternatives in the smart home security market. Despite competitors like Amazon Echo being released in June 2015, Nest + iSecurity + iHome utilizes this acquisition as a high-security investment for consumers but also allows consumers to control certain things in the home even when they’re away, like lights, AC, electric stoves, etc.

The second advantage is that…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy