Ant Financial (A) - Case Solution

Ant Financial, a fintech "Unicorn," has its headquarters in Hangzhou, China, and offers various services such as mobile and online payment, online banking, social credit scoring system, and an insurance platform, among others. As the company continues to show progress and growth over the years, its Chief Strategy Officer, Long Chen, is looking into and considering international expansion. He contemplates the opportunities and threats that the company would face if it proceeded with this move.

Case Questions Answered

- Describe the development of Ant Financial and the company's range of products and services.

- Explain the firm's business strategy and competitive advantages/limitations.

- Explain the firm's risk management strategy.

- Discuss the firm's rural strategy. Explain how--in the absence of a high-quality infrastructure system and other challenges--the firm should develop its inclusive financial initiative in China's rural areas.

- Discuss the advantages and disadvantages of Ant's current internationalization strategy and its focus on mergers.

- Discuss how Ant Financial should manage its relationship with traditional banks and address regulatory uncertainties at the domestic and international levels.

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Overview – Ant Financial

Ant Financial’s Mission: Facilitate industrial innovation and consumption upgrade, serving inclusive, convenient, and sustainable services and providing safe and reliable products to consumers.

The Chinese Market

The Chinese market is advanced when it comes to technology and the proliferation of smart devices. It has the legal framework for digital transformation and has inclusive financial initiatives.

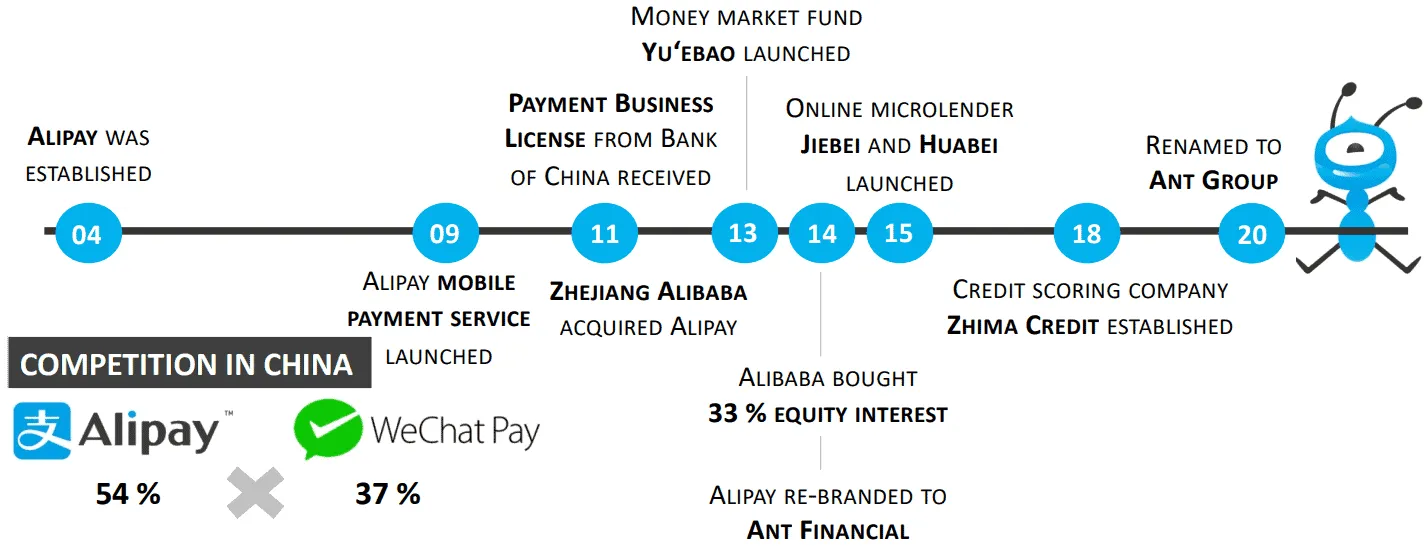

Timeline of Company Development

Products and Services Offered by Ant Financial

Ant Financial offers several products and services. It includes a mobile app called Alipay, which is an online payment platform. Likewise, it offers Ant Fortune, a personal investment and wealth management platform.

The company also offers online, short-term credit services through its platform, Ant Credit Pay, and a money market fund through Yu’e Bao. It has internet-baking services through MYBank, a social credit scoring system through Zhima Credit, an insurance platform called ZhongAn Insurance, and Ant Financial Cloud, a cloud technology platform.

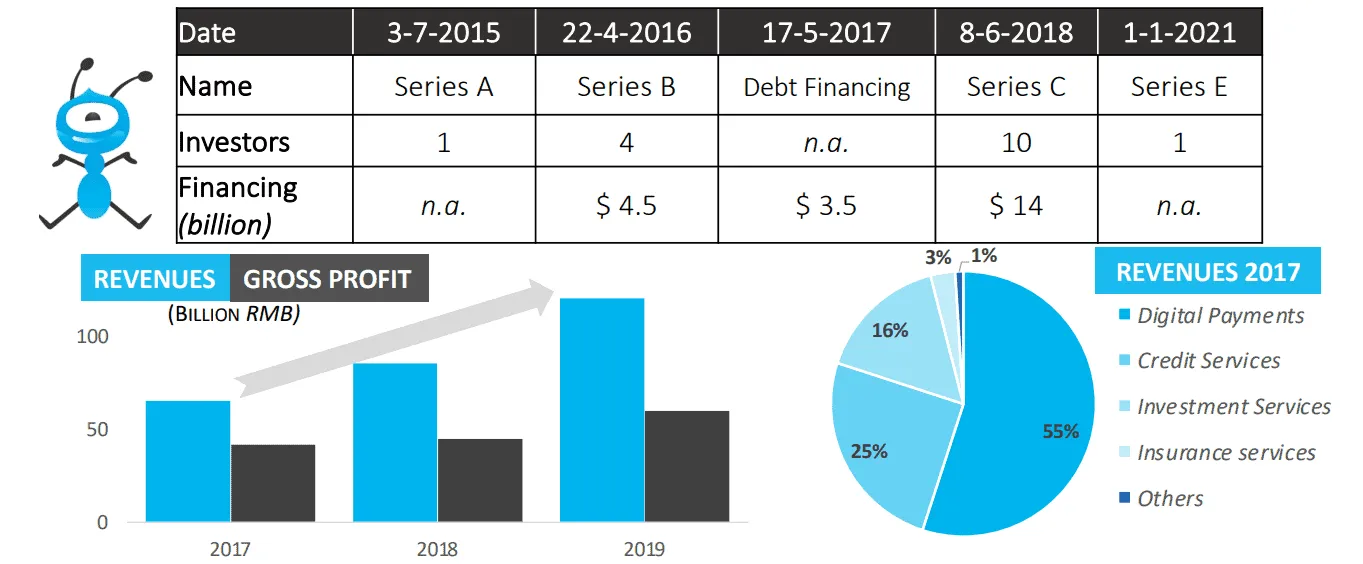

Company’s Financial Background

Business Strategy: Advantages and Limitations

Business Models

- Commission Fee

- Advertisement

- Investment

- Capital Interest

Main Advantages

- Scenarization

- Data

- Processing Capacity

- Risk Management

Key Ingredients

- Transaction Security

- Availability and convenience

- Built trust, thanks to the use of Escrow

Limitations

- Not attractive to big enterprises

- The proliferation of Fintech competitors

- Rural Infrastructure

Rural Strategy

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy