Angus Cartwright IV - Case Solution

This case study discusses the four potential properties that Angus Cartwright has identified for real estate acquisitions. Judy and John DeRight retained Mr. Cartwright. Both Judy and John DeRight are planning to expand their investment portfolio in the real estate industry. This case study allows students to calculate the Purchase and Operating Comparables, Breakeven Analysis, Cashflow Forecast, Financial Analysis, etc., of the four real estate properties.

Case Questions Answered

- List of salient Facts

- First-Year Project Setup (EBIT)

- Purchase and Operating Comparables

- Breakeven Analysis

- Cashflow Forecast

- Financial Analysis

- Investment Ranking

- Percent of Total Benefits based on IRR

- Breakdown of futures

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

Angus Cartwright IV Case Study Analysis

This case study discusses the four potential properties Angus Cartwright has identified for real estate acquisitions.

Judy and John DeRight retained Mr. Cartwright. Both Judy and John DeRight are planning to expand their investment portfolio in the real estate industry.

The four prospective properties are Allison Green, Stony Walk, Ivy Terrace, and Fowler Building. Mr. Cartwright is now tasked to compare and contrast the four prospective properties.

He must also provide the necessary financial calculations for the couple to render the most beneficial decision.

Case Problems:

Calculate the following for the four properties identified by Angus Cartwright:

- List of salient Facts

- First-Year Project Setup (EBIT)

- Purchase and Operating Comparables

- Breakeven Analysis

- Cashflow Forecast

- Financial Analysis

- Investment Ranking

- Percent of Total Benefits based on IRR

- Breakdown of futures

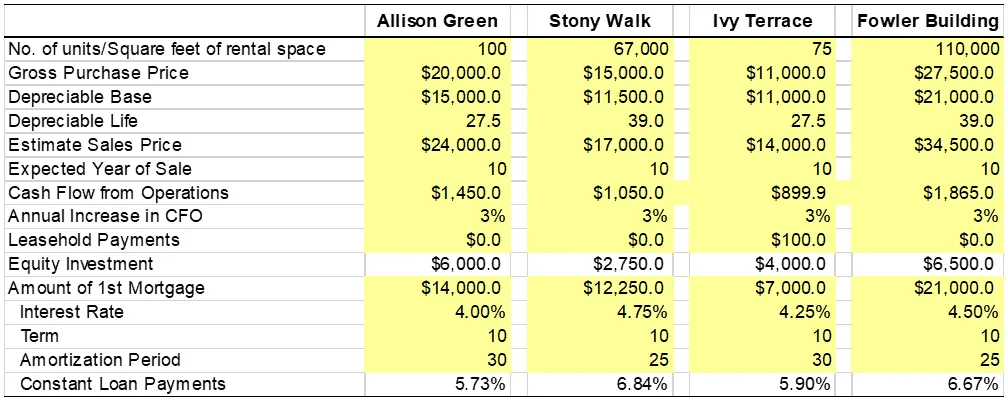

Exhibit 1 – List of Salient Facts

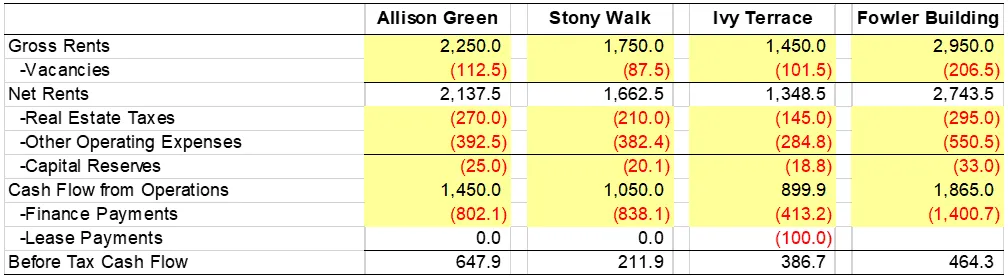

Exhibit 2 – First-Year Project Setups

Exhibit 3 – Purchase and Operating Comparables

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy