American Chemical Corp. - Case Solution

William E. Fruhan and John P. Goldsberry | Harvard Business Review ( 280102-PDF-ENG ) | March 01, 1980 (Revision: 2023-09-09)

Abstract:

This case study looks into the acquisition of a plant by a small chemical manufacturer. It allows students to compute and look at the projected cash flow associated with the acquisition.

Case Questions Answered

- Estimate the Cost of Equity.

- Estimate the Cost of Debt and the WACC.

- Project the Cash Flow without Laminate Technology.

- Project the incremental cash flows associated with the acquisition of Collinsville.

- Would you invest in the new plant without the new technology?

- Would you invest in the new plant with investment in new technology?

This case solution includes an Excel file with calculations that will be available after purchase.

This case solution includes an Excel file with calculations.

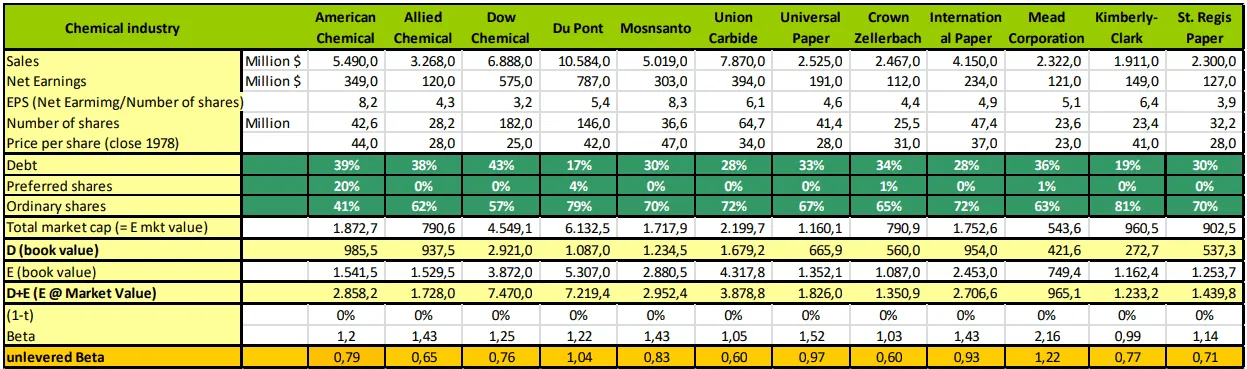

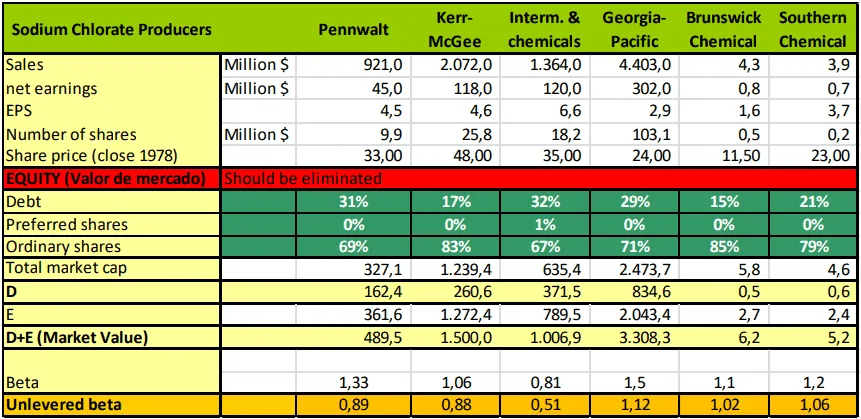

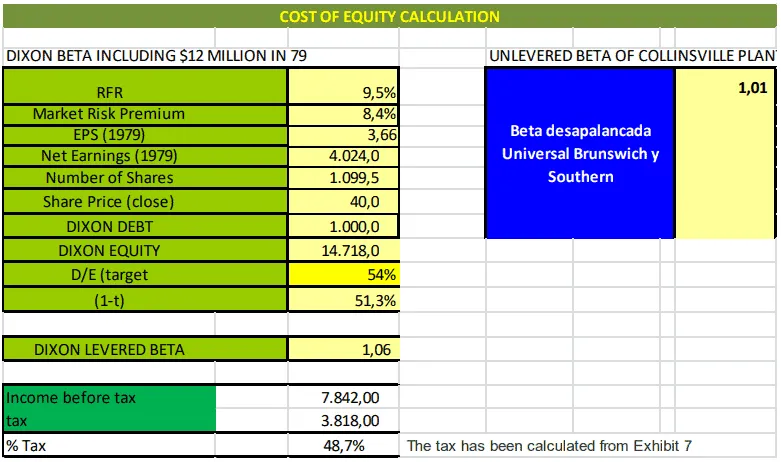

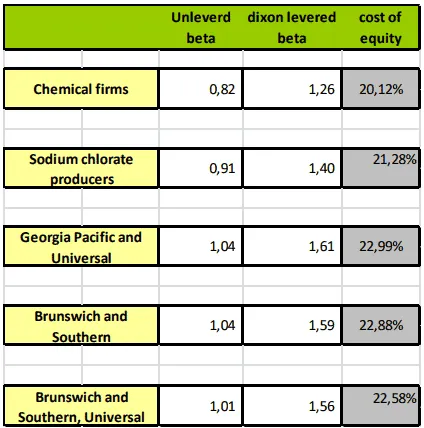

1. Estimate the Cost of Equity for American Chemical Corp.

2. Estimate the Cost of Debt and the WACC

Preview Only — Unlock Full Content Below

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Buy Full Case Solution

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy