Accounting for the iPhone at Apple Inc. - Case Solution

Accounting for the iPhone at Apple Inc. case study deals with the changes in the company's accounting method. For years, the company has employed the subscription accounting in recognizing revenue for its products. Sometime in 2008, it started recognizing all revenues upfront through the provision of non-GAAP supplemental numbers.

Case Questions Answered

- What do the GAAP and non-GAAP accounting transactions for the iPhone at Apple Inc. look like?

- What are the effects of the different revenue recognition methods on Financial Statements?

- GAAP vs. Non-GAAP: What is a better representation of the economic success of the iPhone?

- Should Apple lobby the FASB to change the revenue recognition rules for smartphones? What is the impact of FABS adopting new rules for Revenue Recognition?

1. What do the GAAP and non-GAAP accounting transactions for the iPhone

at Apple Inc. look like?

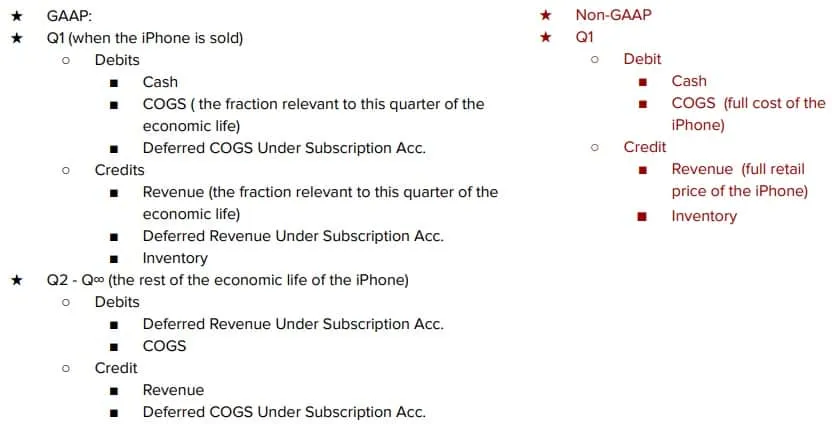

The GAAP and Non-GAAP accounting transactions for the iPhone at Apple Inc. look like the following:

2. What are the effects of the different revenue recognition methods on

Financial Statements?

Financial Statements Use Subscription Accounting

It occurs when a product has future services included, in this case, free software updates.

Revenue Recognition:

- Due to the free software updates after the sale of the iPhone, the full revenue of the iPhone cannot be recognized at the point of purchase. This non-recognition is because of the non-fulfillment of a part of the service. As such, a part of the expenses of Apple Inc. has not been incurred.

- Thus, a fraction of the iPhone sales price is recognized, and the rest is unearned revenue to be recognized over on a straight-line basis for 24 months. An ⅛ of the income associated with an iPhone was recognized quarterly.

- In line with the revenue recognition concept in the Sarbanes Oxley Act.

Expense Matching:

- Since the full revenue of the iPhone sale is not recognized at the point of sale, the total COGS expense is…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy