$19B 4 txt app WhatsApp...omg! - Case Solution

Sometime in early 2014, Facebook declared that it is acquiring WhatsApp for $19 billion. This "$19B 4 txt app WhatsApp...omg!" case study seeks to look into how Facebook, after the acquisition of WhatsApp, can integrate the app including, but not limited to, monetization and leveraging synergies, to maximize the $22bn investment.

Case Questions Answered

- Was it worth it for Facebook to buy WhatsApp for its acquisition price?

- How can Facebook run WhatsApp to recoup the investment?

WhatsApp: The Best Facebook Purchase Ever?

An Analysis of the Synergies and Monetization Options of WhatsApp

Following its Acquisition by Facebook in 2014

Management summary

- How can Facebook integrate WhatsApp after its acquisition, including but not limited to monetization and leveraging synergies, to maximize the $22bn investment?

- Facebook, as a holding company, should both leverage the strategic synergies and realize the monetization potential of WhatsApp in sequential waves in the next eight years.

1.1) Facebook should stimulate its engagement rates – especially among teens

1.2) Facebook should build up a user base in the Asian market

1.3) Facebook should leverage WA’s capabilities as a photo-sharing platform and SMS replacement tool

2.1) WA should follow other peer’s “Freemium” (such as Line), adding stickers and games to the app’s capabilities in 2015 – leading to expected USD 1.5 Bn additional revenues

2.2) WA should add P2P payments in 2015 as they will become a meaningful business in the following years – leading to expected USD 0.2 Bn additional revenues

2.3) WA should return to a subscription model in 2017, starting at 1$ per user and increasing the fee by 0.25$ with each $500 million increase in total users – leading to expected USD 2.3 Bn additional revenues

2.4) WA should increase its revenues through advertising in 2020, going gradually from low to high disruption until 2020 – leading to expected USD 5.1 Bn additional revenues in 2022.

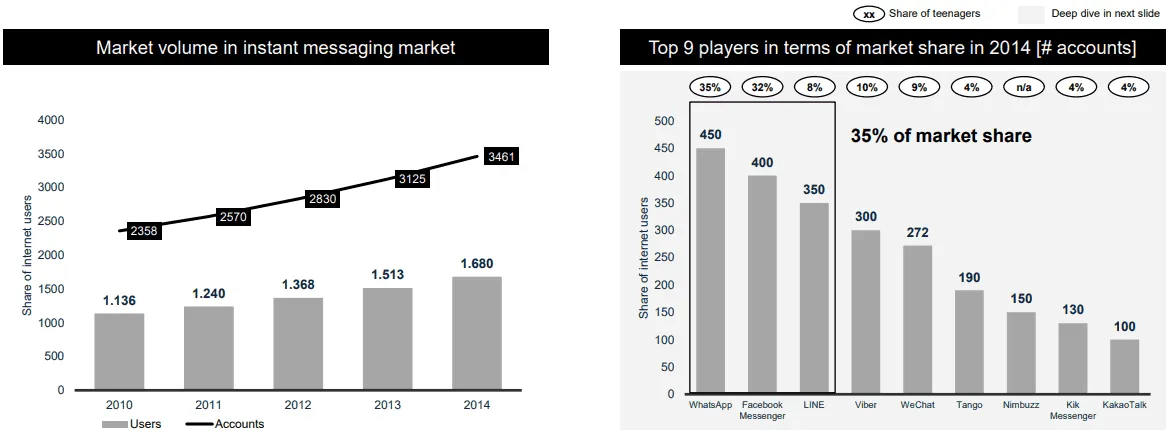

The messaging service industry had an attractive 10% CAGR between 2010 and 2014, while organic growth is difficult as the market is very consolidated.

Very attractive industry to enter for any technology player, especially through acquisitions:

- Attractive market growth of 50% between 2010 and 2014

- Untapped potential due to only 1.7bn users (23% of the global population) using instant messaging in 2014

- A consolidated market with fierce competition could make organic growth difficult

The 2014 picture of the IM industry created through the Five Forces analysis exposes a…

Complete Case Solution

Get immediate access to the full, detailed analysis

- Comprehensive answers to all case questions

- Detailed analysis with supporting evidence

- Instant digital delivery (PDF format)

Secure payment • Instant access

By clicking, you agree to our Terms of Use, Arbitration and Class Action Waiver Agreement and Privacy Policy